An In-Depht Review Of Funded Trading Plus

Funded Trading Plus Introduction

Funded Trading Plus, legally established as FTP London LTD on November 2, 2021, and headquartered at 7 Bell Yard, London, is managed by directors James Anthony Frangleton and Simon Paul Massey. The company does not provide its services in specific countries, such as Cuba and North Korea. It offers three main types of challenges for traders: Single-Phase Challenge, Two-Phase Challenge, divided into Premium and Advanced categories, and the noteworthy Master Trader Program, which allows direct access to a funded account.

Funded Trading Plus enhances traders financial capabilities through its scaling plan, with an initial profit split of 80/20 and potentially reaching 100/0 based on market performance. The company offers a variety of tradable assets, including metals like silver, gold, and platinum, several indices, and cryptocurrencies, each with specific conditions. Commodities such as oil instruments are also available.

In collaboration with Gooey Trade as a liquidity provider, Funded Trading Plus offers access to trading on DXtrade, Match Trader and cTrader platforms. The company provides varied leverage sizes for different assets and detailed information on spreads at various times of the day. Deposit and withdrawal options include debit/credit cards and cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Dogecoin, Tether, and USD Coin, with varying conditions in different programs and a regulated profit split depending on performance.

Customer support is available via email, live chat, and social media. Educational materials are accessible through blogs and videos. FundedTradingPlus has an active presence on social media platforms like Twitter, Instagram, Facebook, TikTok, Discord, and YouTube. Customer reviews on Trustpilot are generally positive, highlighting good customer service and quick funding processes. The affiliate program offers a 20% commission on new referrals, in accordance with specified terms.

In summary, Funded Trading Plus, in partnership with Gooey Trade, provides a comprehensive and efficient trading environment with a wide range of assets, competitive leverage and spread options, supported by a robust support system.

Company Profile

Funded Trading Plus

Location of Operations:

7 Bell Yard, London, England, WC2A 2JR

Company Info:

Trading Company: FTP LONDON LTD

Registration Date: 2 November 2021

Company Number: 13719292

UK VAT Number: 413 8673 88

European VAT Number: EU372045061

Legal form: Limited liability company

Restricted countries: Cuba, North Korea, Syria, Islamic Republic of Iran, Myanmar

CEO of Funded Trading Plus: Simon Massey is the Chief Executive Officer (CEO) and Co-Founder of Funded Trading Plus. He previously led a Data Mesh platform engineering team, served as a Senior Technical Advisor at UniqKey, and was a Principal Engineering Coach at Consensus Solutions Limited.

LinkedIn: https://www.linkedin.com/in/simon-massey-82718a3

Key Information

2-phase Advanced Challange

| Challenge name | Two-Phase Advanced |

|---|---|

| Challenge fee 100 000$ | $449 (after discount) |

| FX leverage | 1:30 |

| EA trading | Yes |

| News trading | Yes |

| Weekend holding | No |

Funded Trading Plus in Detail

Challenge Types

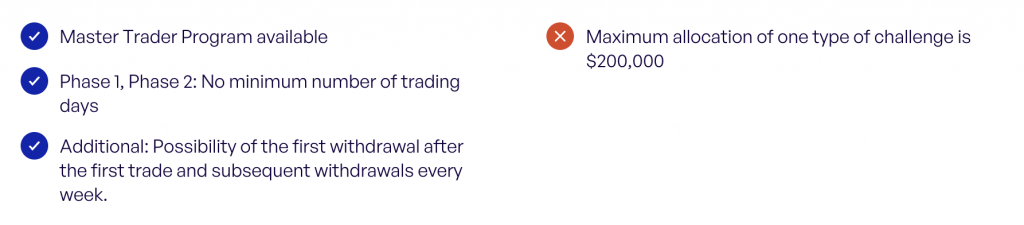

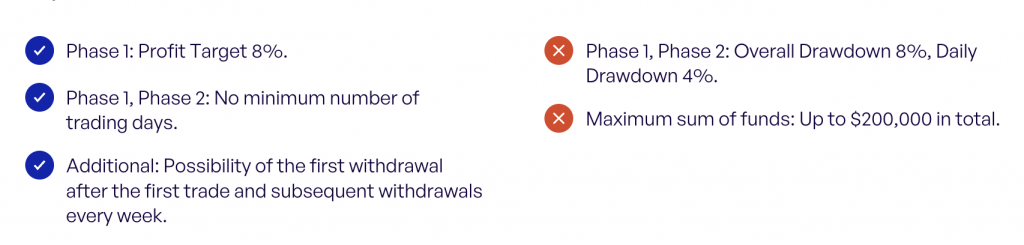

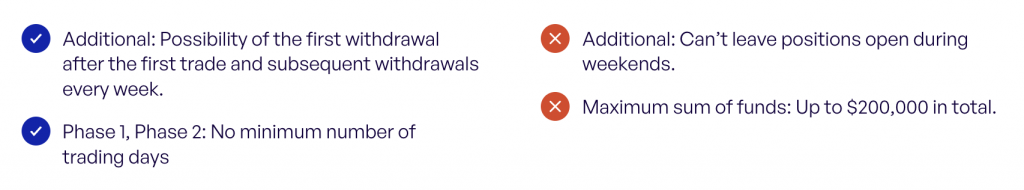

Two-Phase Premium

The Two-Phase Premium challenge involves two phases to qualify for a proprietary trading funded account. Investors choose, Dollar, denomination with four account sizes. The maximum total funds available is $200,000.

Phase one requires an 8% profit with, daily drawdown up to 4%, overall drawdown up to 8%. There are also no limits regarding the maximum number of trading days and no minimum trading days.

Phase two involves a 5% profit with similar drawdown conditions. The funded account phase has no specific profit targets, daily drawdown up to 4%, overall drawdown up to 8%, and no minimum trading days.

Advancement grants a 100% refundable fee, with the first withdrawal possible after 0 days. Subsequent withdrawals can be made every week, and the profit split is 80/20 but with the scaling plan, it can increase to 100/0%.

| Trading during weekends | No |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

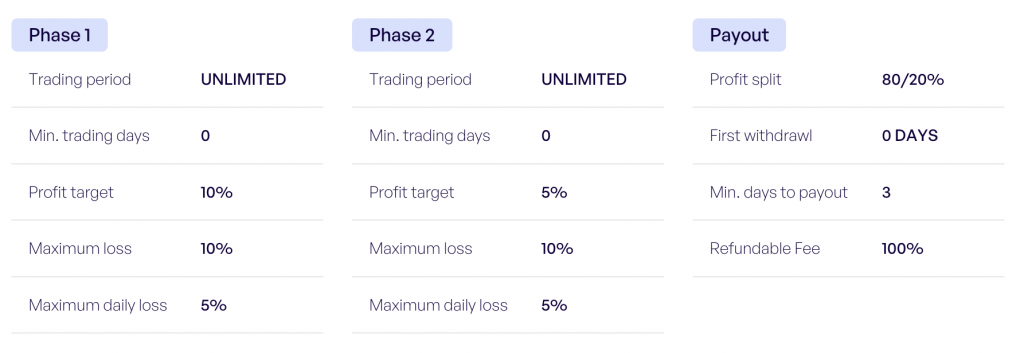

Two-Phase Advanced

The Two-Phase Advanced challenge involves two phases to qualify for a proprietary trading funded account. Investors choose, Dollar, denomination with four account sizes. The maximum total funds available is $200,000.

Phase one requires an 10% profit with, daily drawdown up to 5%, overall drawdown up to 10%. There are also no limits regarding the maximum number of trading days and no minimum trading days.

Phase two involves a 5% profit with similar drawdown conditions. The funded account phase has no specific profit targets, daily drawdown up to 5%, overall drawdown up to 10%, and no minimum trading days.

Advancement grants a 100% refundable fee, with the first withdrawal possible after 0 days. Subsequent withdrawals can be made every week, and the profit split is 80/20 but with the scaling plan, it can increase to 100/0%.

| Trading during weekends | No |

|---|---|

| Weekend Holding | No |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

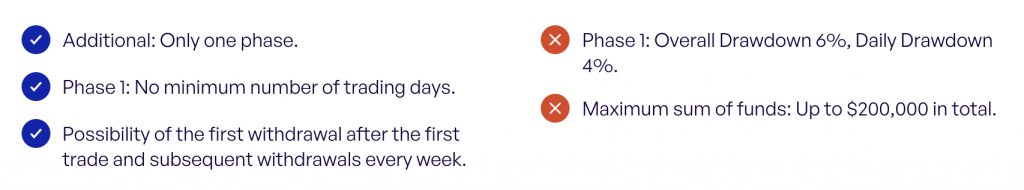

One-Phase Experienced

The One-Phase Advanced challenge involves one to qualify for a proprietary trading funded account. Investors choose,Dollar, denomination with five account sizes. The maximum total funds available is $200,000.

Phase one requires an 10% profit with, daily drawdown up to 4%, overall drawdown up to 6%. There are also no limits regarding the maximum number of trading days and no minimum trading days.

Advancement grants a 100% refundable fee, with the first withdrawal possible after 0 days. Subsequent withdrawals can be made every week, and the profit split is 80/20 but with the scaling plan, it can increase to 100/0%.

| Trading during weekends | No |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

Master Trader Program

Investors choose Dollar denomination with five account sizes. The maximum total funds available is $100,000.

Funded Trading Plus doesn’t refund fees. The first withdrawal can be made after the first trade, and subsequent withdrawals can be made every week at the FT+ Trader stage. Minimum withdrawal is 50$. The Profit Split is 80/20, meaning the investor receives 80% of the profit generated.

| Trading during weekends | No |

| Weekend Holding | No |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

Scaling Plan

Rate: 4

80% of your simulated profit made during the FT+ Trader phase can be withdrawn by you upon request. This withdrawal process is user-friendly and streamlined, as the amount eligible for withdrawal is automatically calculated at the time you initiate a payout request.

Moreover, the FT+ Trader program offers progressive incentives for successful trading. When you, as an FT+ Trader, achieve a milestone of 10% simulated profit (Experienced Trader Program, Master Trader Program and Premium Trader Program) or 20% simulated profit (Advanced Trader Program) in your simulated-live account, an opportunity arises for you to enhance your profit-sharing ratio. At this juncture, you can submit a request to modify the split of simulated profits to a more favorable ratio of 90/10. This adjusted ratio means that a larger portion of the profits – 90% – will be attributed to your account.

The incentives do not end there. As you continue to excel in your trading strategies and reach a higher benchmark of 30% simulated profit, the program offers an even more advantageous profit split. You are then eligible to request a transition to a 100/0 profit split. This exceptional split arrangement entitles you to the entirety of the simulated profits – a full 100%, reflecting the program’s commitment to rewarding skillful trading and strategic acumen.

This tiered profit split structure is designed not only to reward your trading successes but also to motivate continuous improvement and engagement with the trading platform. It’s a system that acknowledges and incentivizes your growth and proficiency as a trader within the simulated environment.

Advanced Trader Program

In this example, assuming customers do not withdraw, a customer with a simulated balance of $120,000 can ask to scale to $200,000. The customer would have the same amount of simulated profit on the new account balance of $220,000. ($20,000 in this example). The new static maximum simulated loss limit has been changed from $100,000 to $200,000.

In this example, customers now need to make an additional $20,000 of simulated profit to be able to scale on the simulated $200,000 level to scale to the next simulated level of $400,000. The customer would be free to withdraw simulated profit as suits their circumstances and trading risk profile.

Example of Scaling Plan

| FT+ Account Starting Size (plus the profit you made from the last level) | Balance Required For Next Level | Balance Required For Next Level | |

|---|---|---|---|

| Funded Account | 25 000$ | 20% | 30 000$ |

| Second scaling | 50 000$ | 20% | 60 000$ |

| Third scaling | 100 000$ | 20% | 120 000$ |

| Fourth scaling | 200 000$ | 20% | 240 000$ |

| Fifth scaling | 400 000$ | 20% | 480 000$ |

| Sixth scaling | 800 000$ | 20% | 960 000$ |

| Seventh scaling | 1 600 000$ | 20% | 1 920 000$ |

| Eighth scaling | 2 500 000$ | 20% | – |

Experienced Trader Program, Premium Trader Program and Master Trader Program

In this example, assuming traders do not withdraw, a trader with a simulated balance of $110,000 can ask to scale to $200,000. The trader would have the same amount of simulated profit on the new simulated account balance of $210,000. ($10,000 in this example). The new static maximum simulated loss limit has been changed from $100,000 to $200,000.

In this example, traders need now to make an additional $10,000 of simulated profit to be able to scale on the $200,000 level to scale to the next level of $400,000. The trader would be free to withdraw simulated profit as suits their circumstances and trading risk profile.

Example of Scaling Plan

| FT+ Account Starting Size (plus the profit you made from the last level) | Balance Required For Next Level | Balance Required For Next Level | |

|---|---|---|---|

| Funded Account | 12 500$ | 10% | 13 750$ |

| 25 000$ | 10% | 27 500$ | |

| 50 000$ | 10% | 55 000$ | |

| 100 000$ | 10% | 110 000$ | |

| 200 000$ | 10% | 220 000$ | |

| 400 000$ | 10% | 440 000$ | |

| 800 000$ | 10% | 880 000$ | |

| 1 600 000$ | 10% | 1 760 000$ | |

| 2 500 000$ | – | – |

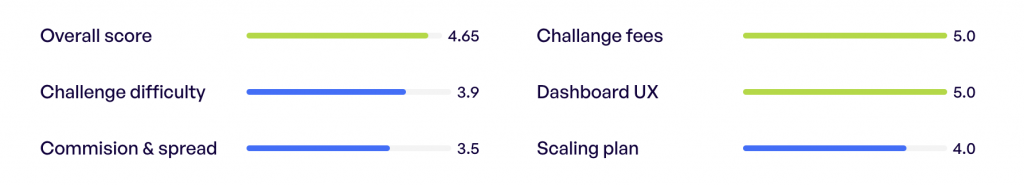

Challenge Fees

Rate: 5

Comparison of Direct Challenge Costs

We compare the direct costs of participating in the challenge offered by Funded Trading Plus – Two-Phase Advanced with the average market costs. This analysis enables understanding of how Funded Trading Plus fares against its competitors in terms of pricing. The costs for the challenge at Funded Trading Plus for the Two-Phase Advanced Challenge are below the market average.

*The price includes a discount available on the website.

| Challenge Size | Market Average Price | Challenge Price | Difference |

|---|---|---|---|

| 25 000$ | 209$ | 179$* | -30$ |

| 50 000$ | 310$ | 314$* | +4$ |

| 100 000$ | 515$ | 449$* | -66$ |

| 200 000$ | 969$ | 854$* | -115$ |

Comparison of Costs Relative to Drawdown

It is important to note that the size of drawdown has a significant impact on what we actually receive for the money spent. The Evaluation Challenge has a drawdown at the level of 10%. Therefore, we additionally compare how much drawdown we receive in relation to the dollar spent.

| Challenge Size | Market Average Price [Drawdown $ / $] | Challenge Price [Drawdown $ / $] | Difference [Drawdown $ / $] |

|---|---|---|---|

| 25 000$ | 11,4 | 14,0 | +2,6 |

| 50 000$ | 15,4 | 15,9 | +0,5 |

| 100 000$ | 18,5 | 22,3 | +3,8 |

| 200 000$ | 20,4 | 23,4 | +3,0 |

Evaluation of the Cost-Effectiveness of the Funded Trading Plus Account Challenge

Based on the above data, as well as algorithms we have developed, we assess the cost-effectiveness of purchasing the Funded Trading Plus Account Challenge as very good compared to the market average. The expenditure efficiency in the context of drawdown indicates a better cost-effectiveness than the market average.

Assets

Forex

| AUDCAD | AUDCHF | AUDJPY | AUDNZD | AUDUSD |

| CADCHF | CADJPY | CHFJPY | EURAUD | EURCAD |

| EURCHF | EURCZK | EURGBP | EURHUF | EURJPY |

| EURNOK | EURNZD | EURPLN | EURSEK | EURSGD |

| EURTRY | EURUSD | EURZAR | GBPAUD | GBPCAD |

| GBPCHF | GBPJPY | GBPNZD | GBPUSD | GBPZAR |

| NZDCAD | NZDCHF | NZDJPY | NZDUSD | USDBRL |

| USDCNH | USDHUF | USDJPY | USDMXN | USDNOK |

| USDPLN | USDSEK | USDSGD | USDTRY | USDZAR |

Commodities

| XAUUSD | XAUEUR | XAGUSD | WTI | Brent |

Indices

| AUS200 | CHINA50 | ESTX50 | FRA40 | GER40 |

| HK50 | JPN225 | NAS100 | SPAIN35 | SPX500 |

| TAIEX | UK100 | US2000 | US30 | USAINDEX |

| VIX |

Cryptocurrencies

| BTCUSD | ETHUSD | ADAUSD | LTCUSD | SOLUSD |

| XRPUSD |

UX Rating

Rate: 5

The Funding Trading Plus website stands out for its exceptional UX design, offering clear, accessible information, a streamlined registration process, and robust technological and trading infrastructure. It effectively guides users through understanding the company’s services, registering an account, and purchasing a trading challenge. The user-friendly design and consistent branding significantly enhance the user experience. Moreover, the site’s intuitive layout and informative content structure contribute to an effortless navigation experience.

Trading Conditions

Server Provider

The Funded Trading Plus uses Gooey Tradeas its liquidity provider.

Gooey Trade

Gooey Trade are a tech provider and act as the bridge between the broker and prop firms. They are experts in managing and administering various trading platforms.

Currently Gooey Trade have integrated with platforms using the ThinkMarkets pricing feeds, this means that traders will have a similar platform experience as if they were trading on a ThinkMarkets account. In terms of spreads, commissions and pricing, the experience is the same as ThinkMarkets.

It’s important to note that whilst trade.gooeytrade.com is branded as GooeyTrade, it is actually DXtrade under the hood.

Platforms

Funded Trading Plus offers trading on the DXtrade, Match Trader and cTrader platforms.

Leverage

The size of leverage offered by the prop-trading firm Funded Trading Plus is:

- For Forex and Commodities: 1:30

- For Indices: 1:20

- For Cryptocurrencies: 1:2

Deposits and Withdrawals

Deposits

For the Funded Trading Plus Challenge, you can pay via debit/credit card or cryptocurrencies. Funded Trading Plus accepts MasterCard, Visa, and cryptocurrencies like:

| Bitcoin | Ethereum | Dogecoin | Litecoin |

| Tether | USD Coin |

Withdrawals

Withdrawals are possible as soon as $50 of simulated profit is reached. Subsequent withdrawals can be made at any time, subject to a minimum of 7 calendar days.

Note: The first withdrawal request in the Premium Program can only be initiated after 7 calendar days of activity.

Increasing Profit Split

Upon achieving 20% overall simulated profit in an account, the split can shift from 80/20 to 90/10. Reaching 30% simulated profit enables a request for the simulated profit split to be changed to 100/0.

Payment Time

All withdrawal requests are processed as quickly as possible, typically within 2 hours of the request, and all payments are processed within 48 hours.

Payout Methods

Withdrawals are currently offered via cryptocurrency including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Dogecoin (DOGE), Tether (USDT), USD Coin (USDC).

Funded Trading Plus has very good reviews regarding payments and withdrawals. Users note their quick processing. There are occasional individual dissatisfaction reviews.

Support

Funded Trading Plus provides customer support through email and live chat. Below is a list of available channels:

- Physical Office Address – United Kingdom, 7 Bell Yard, London, WC2A 2JR.

- Email ID – support@fundedtradingplus.com

- Live Chat – Directly available from the site.

Funded Trading Plus Support Timings – Livechat does work 24/7 but for accounts team they work from 9am to 6pm GMT, Monday to Friday and some limited time on weekend/holidays.

Email Support

You have the option to contact Funded Trading Plus via email. The responses received from customer support can be relevant, but sometimes they are quite generalized and not always comprehensive. Since it typically takes several hours to get a response, we recommend using the Online Chat for faster and more detailed assistance, enhancing the dialogue with additional questions.

Live Chat Support

Funded Trading Plus has very good live chat. Company strongly recommends using their online chat as the primary method of communication. Their expert team is always available in the online chat and aims to quickly and efficiently respond to all inquiries and questions, thereby providing prompt and effective customer support. To start a chat, you need to provide an email address, to which responses from the chat will be sent. Usually, the expected waiting time is between 3 to 10 minutes, depending on the day. The average response time, calculated based on chat interactions, is around 1-2 minutes.

Initially, the live chat connects us with a chatbot. You need to answer a few questions to be able to proceed to a conversation with a human. Live chat experts respond quickly and substantively to the questions asked. In case of doubts, they expand on the topic. They use links with information that can be found on their website. They provide answers to all the asked questions. This method is considered the fastest for receiving support and resolving any possible issues.

Social Media and Communication

Funded Trading Plus actively maintains a social media presence on platforms such as X, Instagram and Facebook, as well as on TikTok, Discord and Youtube.

X – On page X, you can find giveaways, news, as well as recommendations for trading on financial markets. The activity is quite high. The frequency of tweets is over 100 per month.

Instagram – The information here is very similar to that on X. There are promotions, as well as news, giveaways, and trading recommendations. The frequency of publications is around 25 posts per month.

Facebook – The same information as on Instagram is published on Facebook. The frequency of publications is 20-30 per month.

TikTok – On the TikTok platform, you can see short videos with trading recommendations, as well as excerpts from podcasts and interviews with traders about their problems and advantages in trading. The frequency of publications is about 10 per month.

Discord – The Discord channel is very rich with various useful information. For example, there is a chat for promotions, and you will never miss when a company offers discounts on its products. There is also a general chat and a trading chat, where traders share their views on the market and post their trading ideas. There’s a chat for trader payouts from this company. Memes are also shared to lighten up the routine of trading.

YouTube – The company’s team conducts interviews and podcasts with traders from various countries and publishes them on the YouTube platform. There are also educational videos about the products that this company offers. The frequency of publication is not high, 1-2 videos per month.

Engagement rate in social media:

| Platform | Followers | Engagement Rate |

|---|---|---|

| 23000 | 0,39 | |

| X | 20700 | 0,57 |

| 21800 | 2,8 | |

| Youtube | 11000 | 6,33 |

Client Reviews Summary

Rate: 4.9

Evaluations of the Funded Trading Plus platform:

| Review platform | Rating | Number of reviews |

|---|---|---|

| Trustpilot | 4,9 | 2030 |

With an overall rating of 4.9 out of 5, Funded Trading Plus demonstrates a predominantly positive reception among its user base, reflecting well on various aspects of its operations, including customer support. This high rating suggests that the positive experiences significantly outweigh the negative ones for the majority of users. However, it is important to consider this in the context of the detailed aspects of customer support:

Positive Contributions to High Rating:

- Good Customer Service: Many users positively rate the company’s quick and responsive customer service.

- Fast Funding and Easy Withdrawals: The company is valued for its quick funding processes and the ease of making withdrawals.

- Transparency and Fairness: Users appreciate the company’s transparency and fairness, including its commitment to solving technical issues.

- Community Support and CEO Engagement: Positive reviews refer to the active engagement of the CEO in the community and the support offered by the company.

- Good Challenge Structure: Users praise the challenge structure and favorable pricing, as well as the account scaling programs.

Negative Aspects Impacting the Rating:

- High Commissions and Hidden Costs: Users complain about high commissions and a lack of transparency in their presentation.

- Issues with Slippage and Order Execution Delays: Problems with high slippage and delays in order execution on the platform are reported.

- Drawdown and Maximum Loss Rules: Some users indicate that the rules regarding drawdown and maximum losses are unclear or unfavorable for traders.

- Problems with Broker Partner and Manipulations: Complaints arise about issues with the company’s broker partner, including manipulations during significant market events.

- Reports of Scams and Unfair Practices: Some users accuse the company of scams, unfair practices, and problems with profit withdrawals.

Conclusion:

Funded Trading Plus has one of the highest ratings in the industry. The high overall rating emphasizes that positive aspects such as professionalism and good customer service significantly outweigh the negative experiences of most users. It’s noteworthy that the company responds to most negative comments, indicating a commitment to improving services.

Additional Features

Drawdown Calculator

The Drawdown Calculator allows for the calculation of the daily drawdown for each of the accounts offered by Funded Trading Plus. By specifying the type of challenge and information about the account’s balance and equity, the calculator computes the daily drawdown.

Online Platform Test

Here, you can check spreads, execution speed and lot size. This is a $100,000 1:30 leverage account on the same server as their programs. Drawdown is removed so that this demonstration account is not breached. You can pull up the account and take trades.

To check lot size calculations:

$200,000 multiply by 2

$50,000 divide by 2

$25,000 divide by 4

$12,500 divide by 8

Funded Trading Plus does not directly offer individual demonstration accounts to practice trades on.

Summary

Funded Trading Plus, legally established on November 2, 2021, as FTP London LTD and headquartered in London at 7 Bell Yard, is steered by directors James Anthony Frangleton and Simon Paul Massey. Notably absent from its service areas are specific countries such as Cuba and North Korea. This company stands out for its innovative approach to trading, presenting three distinct types of challenges for traders: the One Phase, Two Phase, and the unique Master Trader Program.

Funded Trading Plus’s offers a Scaling Plan. It’s a model that aligns market successes with opportunities for traders to expand their account balances and maximize drawdown limits. Essentially, it’s a system that progressively augments trading capabilities as traders demonstrate profitable results, fostering a balanced and responsible development environment within the Funded Trading Plus ecosystem.

Funded Trading Plus supports its clients with a range of deposit and withdrawal options, including debit/credit cards and various cryptocurrencies. These options come with different conditions across various programs, accompanied by a regulated profit split that adjusts in line with performance.

Customer support is robust, accessible via email, live chat, and social media, Educational resources are readily available through blogs and videos. The company maintains an active presence on social media platforms including Twitter, Instagram, Facebook, TikTok, Discord, and YouTube. Feedback on Trustpilot generally praises the company for its excellent customer service and swift funding processes. Additionally, an affiliate program offers a 20% commission on new referrals, adhering to specific terms.

In summary, Funded Trading Plus crafts a comprehensive and efficient trading environment, characterized by a wide range of assets, competitive leverage and spread options.

![10% Off For Traders Discount Code [2024]](https://fxprop.com/wp-content/uploads/2024/01/24.png)