Blue Guardian Honest Review [2024]

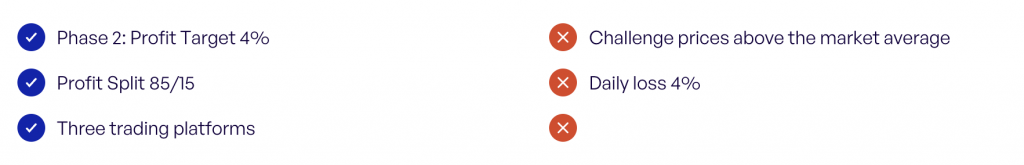

Blue Guardian is a company established in 2021 in the United Arab Emirates. It offers one and two-phase challenges with 5 account sizes, ranging from $10,000 to $200,000. The advantage is a 4% profit target in phase 2 of the challenges and an 85/15 profit split. Maximum sum of funds is $400,000 per customer. The platform offers a growth opportunity where traders can increase their funds every quarter, up to $2,000,000.

It enables trading in the forex market, commodities, indices, and cryptocurrencies. Blue Guardian uses three liquidity providers – Match-Trader, Purple Trading SC and ThinkMarkets. Customers can use the cTrader, Match-Trader and DXtrade platforms. The company accepts payments by credit/debit card and cryptocurrencies.

Customer support is available all week through email, live chat and Discord channel ticket system. Company is active on social media as X, Instagram, Discord, YouTube and Telegram. Customer reviews are generally positive – 4.6 on Trustpilot.

Company Profile

Blue Guardian

Location of Operations:

Dubai Silicon Oasis, DDP, Building A2, Dubai, United Arab Emirates

Company Info:

Date of Incorporation: June 2021

Type: Financial Services

Restricted countries: Cuba, Iran, North Korea, Syria, Pakistan, Vietnam, Kenya, Myanmar.

CEO of Blue Guardian: Sean Bainton has firsthand knowledge of the industry, offering a variety of trading services from signal provision to using machine learning and quantitative analysis to create trading bots. Under Sean’s leadership, Blue Guardian has developed a strong short and long-term strategy, and he has been instrumental in creating and implementing the company’s vision and mission.

X: https://twitter.com/BaintzCEO

Key Information

2-phase Challenge

| Challenge name | Elite Challenge |

| Challenge fee 100 000$ | $542 (after discount) |

| FX leverage | 1:50 |

| EA trading | Yes |

| News trading | Yes |

| Weekend holding | Yes |

Blue Guardian In Detail

Challenge type

Unlimited Challenge

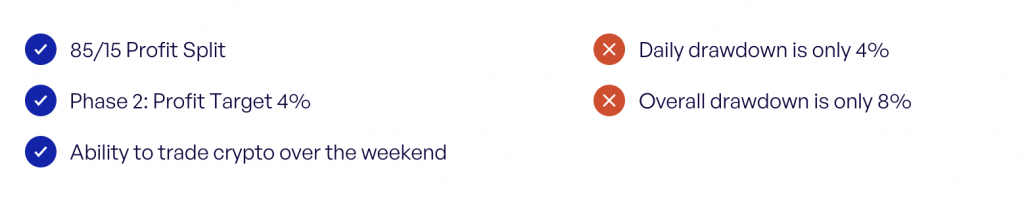

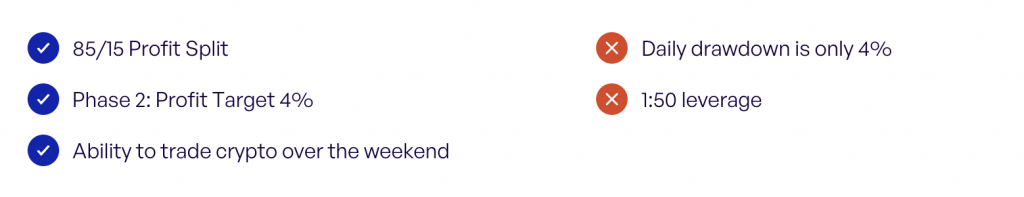

The Unlimited Challenge involves two phases to qualify for a proprietary trading funded account. Investors can choose only Dollar, with five account sizes. The maximum total funds available is $400,000.

Phase one requires an 8% profit with, daily drawdown up to 4%, overall drawdown up to 8%. There are also no limits regarding the maximum number of trading days and minimum trading days.

Phase two involves a 4% profit with similar drawdown conditions. The funded account phase has no specific profit targets, daily drawdown up to 4%, overall drawdown up to 10%. There are also no limits regarding the maximum number of trading days and minimum trading days.

Advancement grants a 100% refundable fee, with the first withdrawal possible after 14 days. Subsequent withdrawals can be made every two weeks, and the profit split is 85/15.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

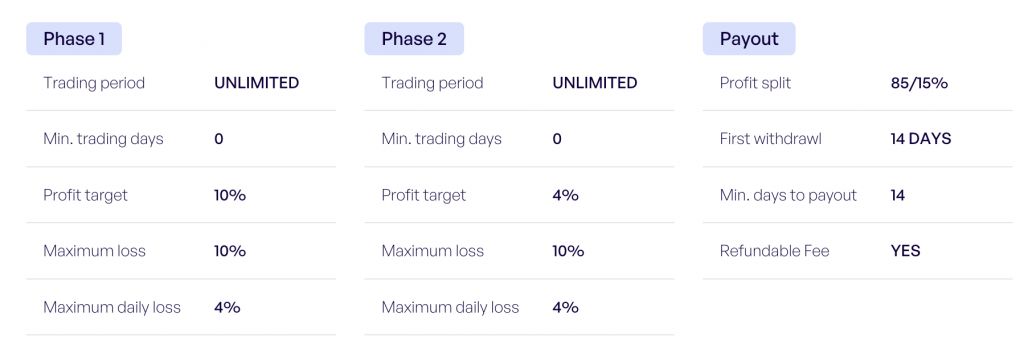

Elite Challenge

The Elite Challenge involves two phases to qualify for a proprietary trading funded account. Investors can choose only Dollar, with five account sizes. The maximum total funds available is $400,000.

Phase one requires a 10% profit with, daily drawdown up to 4%, overall drawdown up to 10%. There are also no limits regarding the maximum number of trading days and minimum trading days.

Phase two involves a 4% profit with similar drawdown conditions. The funded account phase has no specific profit targets, daily drawdown up to 4%, overall drawdown up to 10%. There are also no limits regarding the maximum number of trading days and minimum trading days.

Advancement grants a 100% refundable fee, with the first withdrawal possible after 14 days. Subsequent withdrawals can be made every two weeks, and the profit split is 85/15.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

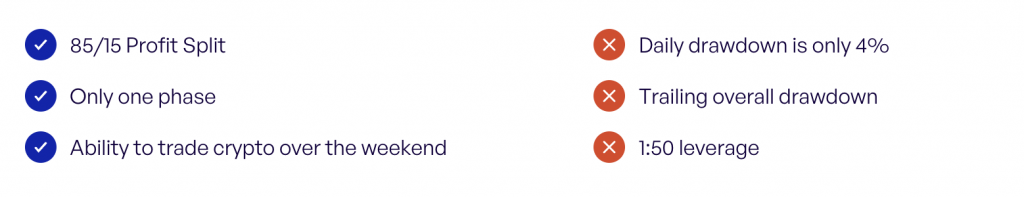

Rapid Challenge

The Rapid Challenge involves one phase to qualify for a proprietary trading funded account. Investors can choose only Dollar, with five account sizes. The maximum total funds available is $500,000.

Phase one requires a 10% profit with, daily drawdown up to 4%, overall relative drawdown up to 6%. There are also no limits regarding the maximum number of trading days and minimum trading days.

Advancement grants a 100% refundable fee, with the first withdrawal possible after 14 days. Subsequent withdrawals can be made every two weeks, and the profit split is 85/15.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

Scaling Plan

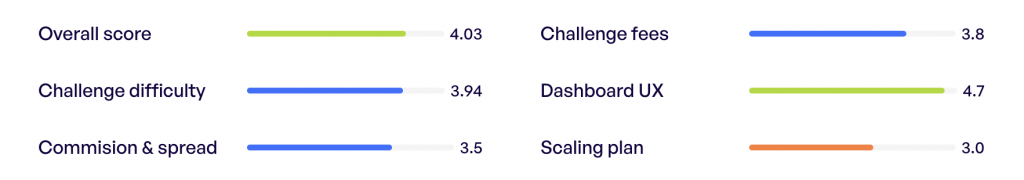

Rate: 3.0

On the Blue Guardian platform, the account scaling process is conducted in 3 months cycles. For an investor to qualify for a capital increase, a minimum net profit of 12% must be generated over three consecutive months. This translates to an average of at least 4% net profit per month for a standard account. After meeting the requirements, the account size increases by 30%. Traders can grow your account to a maximum of $2,000,000.

Challenge Fees

Rate: 3.8

Comparison of Direct Challenge Costs

We compare the direct costs of participating in the challenge offered by Blue Guardian – Elite Challenge with the average market costs. This analysis enables understanding of how Instant Funding fares against its competitors in terms of pricing. The costs for the challenge at Instant Funding for the challenge are slightly above the market average.

*The price includes a discount available on the website.

| Challenge Size | Market Average Price | Challenge Price | Difference |

|---|---|---|---|

| 10 000$ | 108$ | 114$* | +6$ |

| 25 000$ | 209$ | 228$* | +19$ |

| 50 000$ | 310$ | 333$* | +23$ |

| 100 000$ | 515$ | 542$* | +27$ |

| 200 000$ | 969$ | 1036$* | +67$ |

Comparison of Costs Relative to Drawdown

It is important to note that the size of drawdown has a significant impact on what we actually receive for the money spent. The Evaluation Challenge has a drawdown at the level of 10%. Therefore, we additionally compare how much drawdown we receive in relation to the dollar spent.

| Challenge Size | Market Average Price [Drawdown $ / $] | Challenge Price [Drawdown $ / $] | Difference [Drawdown $ / $] |

|---|---|---|---|

| 10 000$ | 8,6 | 8,8 | +0,2 |

| 25 000$ | 11,4 | 11,0 | -0,4 |

| 50 000$ | 15,4 | 15,0 | -0,4 |

| 100 000$ | 18,5 | 18,5 | 0 |

| 200 000$ | 20,4 | 19,3 | -1,1 |

Evaluation of the Cost-Effectiveness of the Blue Guardian Account Challenge

Based on the above data, as well as algorithms we have developed, we assess the cost-effectiveness of purchasing the Blue Guardian Account Challenge as poor compared to the market average. The expenditure efficiency in the context of drawdown indicates a similar cost-effectiveness than the market average.

Assets

Forex

cTrader

| AUDCAD | AUDCHF | AUDJPY | AUDNZD | AUDSGD |

| AUDUSD | AUDZAR | CADCHF | CADJPY | CHFHUF |

| CHFJPY | CHFZAR | EURAUD | EURCAD | EURCHF |

| EURCZK | EURGBP | EURHUF | EURJPY | EURMXN |

| EURNOK | EURNZD | EURPLN | EURSEK | EURSGD |

| EURUSD | EURZAR | GBPAUD | GBPCAD | GBPCHF |

| GBPJPY | GBPNZD | GBPSGD | GBPUSD | GBPZAR |

| NOKSEK | NZDCAD | NZDCHF | NZDJPY | NZDSEK |

| NZDSGD | NZDUSD | SGDJPY | USDCAD | USDCHF |

| USDCZK | USDHKD | USDHUF | USDJPY | USDILS |

| USDMXN | USDNOK | USDPLN | USDSEK | USDSGD |

| USDZAR | ZARJPY |

Match-Trader

| AUDCAD | AUDCHF | AUDJPY | AUDNZD | AUDUSD |

| CADCHF | CADJPY | CHFJPY | EURAUD | EURCAD |

| EURCHF | EURGBP | EURJPY | EURNOK | EURNZD |

| EURSEK | EURUSD | GBPAUD | GBPCAD | GBPCHF |

| GBPJPY | GBPNZD | NZDCAD | NZDCHF | NZDJPY |

| NZDUSD | USDCAD | USDCHF | USDCNH | USDJPY |

| USDMXN | USDNOK | USDSEK | USDSGD | USDZAR |

DXtrade

| AUDCAD | AUDCHF | AUDJPY | AUDNZD | AUDUSD |

| EURAUD | EURCAD | EURCHF | EURGBP | EURJPY |

| EURNZD | EURUSD | GBPAUD | GBPCAD | GBPCHF |

| GBPJPY | GBPNZD | GBPUSD | NZDCAD | NZDCHF |

| NZDJPY | NZDUSD | USDCAD | USDCHF | USDJPY |

Metals

cTrader

| XAUUSD | XAGUSD | XPDUSD | XPTUSD |

Match-Trader

| XAGUSD.pro | XAUEUR.pro | XAUUSD.pro |

DXtrade

| XAGUSD | XAUUSD |

Commodities

cTrader

| BRENT | CL | NGAS |

|---|

Match-Trader

| BRENT | WTI |

DXtrade

| BRENT | WTI |

Indices

cTrader

| ASX | CAC | DAX | DOW | FTSE |

| HK50 | NIKKEI | NSDQ | SP | STOXX50 |

Match-Trader

| AUS200 | FRA40 | UK100 | US2000 | US30 |

DXtrade

| AUS200 | ESTX50 | FRA40 | GER40 | JPN225 |

| NAS100 | SPAIN35 | SPX500 | UK100 | US2000 |

| US30 |

Cryptocurrencies

cTrader

| BTCUSD | ETHUSD | BCHUSD | LTCUSD |

Match-Trader

| BTCUSD | BCHUSD | ETHUSD | LTCUSD |

DXtrade

| BTCUSD | ETHUSD | BCHUSD | LTCUSD |

UX Rating

Rate: 4.7

Blue Guardian website stands out for its exceptional UX design, offering clear, accessible information, a streamlined registration process, and robust technological and trading infrastructure. It effectively guides users through understanding the company’s services, registering an account, and purchasing a trading challenge. The user-friendly design and consistent branding significantly enhance the user experience. Moreover, the site’s intuitive layout and informative content structure contribute to an effortless navigation experience.

Trading Conditions

Server Provider

Blue Guardian uses three liquidity providers – Match-Trader, Purple Trading SC and ThnikMarkets.

Match-Trader

Match-Trader offers an ecosystem developed to optimize the performance of various trading tools. Key components include the Match-Trader trading platform, which is a standalone, modern trading platform designed with traders in mind and a mobile-first approach. It utilizes progressive web application technology to adapt to modern investment needs, helping Forex brokers and Prop firms enter or expand in the Forex market. The system includes comprehensive solutions such as the Client Office app for traders, CRM for Forex brokers, and the newly developed Turnkey Prop Trading solution. This solution offers challenge-based trading and a management system for handling funded accounts. An internally developed blockchain-based payment platform facilitates settlements between brokers and traders. The system also provides ultra-fast data transmission and multi-asset liquidity through its strategic partner, Match-Prime Liquidity, which is regulated by CySEC. The proprietary trading server is offered either as a full license or White Label, allowing for branding flexibility, adherence to the highest security standards, and demonstrated high processing efficiency. Match-Trader has few reviews on Trustpilot, and their average rating is only 2.2.

Purple Trading SC

Purple Trading is a Forex broker licensed by the Cyprus Securities and Exchange Commission (CySEC), employing Straight Through Processing (STP) technology. It was registered in Cyprus in 2016 but currently has representations in the Czech Republic and Slovakia. With Purple Trading, investors can trade currencies, CFD contracts, and stocks. The broker also offers several investment solutions for passive income. Its clients can copy trades of professional market participants through PAMM accounts, invest in ETF funds, and two types of partnerships. Additionally, Purple Trading allows algorithmic trading involving advisors, scripts, and robots compatible with MT4 and cTrader. The minimum deposit to start trading through this broker is 100 USD, which is sufficient for both STP and ECN accounts. Purple Trading categorizes its clients into three groups: retail, professional, and experienced retail clientele. The main advantage for the experienced retail client is the ability to trade with higher leverage than what is available to other retail clients. Purple Trading has an average rating of 3.5 on Trustpilot.

ThnikMarkets

Since its inception in 2010, ThinkMarkets has expanded its reach globally, offering Forex and CFD trading services. The broker is regulated by multiple authorities: the FCA (629628) in the UK, ASIC (ACN: 158 361 561) in Australia, CySEC (215/13) in Cyprus, JFSA (1536) in Japan, FSCA (49835) in South Africa, and the FSA (SD060) in Seychelles. ThinkMarkets allows trading in over 3,500 global assets, including Forex, Indices, Commodities, Shares & ETFs, CFDs, and Crypto CFDs. The company’s specialists have developed a unique ThinkTrader trading platform that allows you to use more than 125 indicators and deep chart settings for technical analysis, close multiple orders in one click, and track news in real-time. ThinkMarkets has an average rating of 4.1 on Trustpilot.

Platforms

Blue Guardian offers trading on the cTrader, Match-Trader and DXtrade platforms.

Leverage

Leverage on accounts:

Unlimited

– Fx : 1:100

– Indices : 1:20

– Commodities : 1:20

– Crypto : 1:2

Elite

– Fx : 1:50

– Indices : 1:20

– Commodities : 1:20

– Crypto : 1:2

Rapid

– Fx : 1:100

– Indices : 1:20

– Commodities : 1:20

– Crypto : 1:2

Deposits and Withdrawals

Deposits

To purchase accounts, Blue Guardian offers a debit/credit card payment option through Stripe. Blue Guardian also accepts cryptocurrency through the Coinbase platform (BTC, ETH, USDT).

Withdrawals

Traders qualify for a payout 14 days following their initial transaction on the funded account and are eligible once again 14 days after conducting their first trade subsequent to any withdrawal. For payout eligibility on funded accounts, traders must ensure their account balance exceeds the initial amount and have no recorded violations. Moreover, to be eligible for a payout, all positions must be closed, indicating no active trades or orders.

Payouts are processed within one to two business days. Funded traders may request payouts via their dashboard. Withdrawal options are provided through Riseworks.io, supporting both bank and cryptocurrency withdrawals. Additionally, payments below $1000 can be withdrawn in cryptocurrency.

The minimum withdrawal amount for a funded account is $100, while the minimum for an affiliate withdrawal stands at $30.

Support

Blue Guardian provides customer support through email, live chat and Discord channel ticket system. Below is a list of available channels:

- Physical Office Address – Dubai Silicon Oasis, DDP, Building A2, Dubai, United Arab Emirates

- Email ID – support@blueguardian.com

- Live Chat – Directly available from the site

- Discord server – https://discord.com/invite/blueguardian

- Help Center – https://www.blueguardian.com/faq

Blue Guardian Support Timing – 24/7

Email support

Email support is available at Blue Guardian. While the support provided via email is relevant, responses can sometimes be too general or incomplete. The average response time for emails is several hours. For quicker and more detailed assistance, it is recommended to use the Live Chat feature and enhance the conversation with additional questions.

Live Chat support

Blue Guardian’s Live Chat is the preferred method of communication, staffed by a team of experts ready to address inquiries and issues promptly and efficiently. To initiate a chat, click the chat button located at the bottom right corner of the website. Upon sending your initial message, you’ll have the option to provide your email address for receiving chat responses via email as well. A chatbot informs users that the estimated wait time is under 3 minutes, though actual wait times can vary from 1 to 10 minutes. The median response time, based on user interactions, is approximately 4 minutes. Live Chat responses are informative and knowledgeable, making it the second quickest support option for addressing concerns.

Discord ticket system

The Blue Guardian Discord server features an “open ticket” channel for private communication with the support team. Users can select the type of support ticket they wish to create, leading to immediate connection with support staff, with no wait time for a response. Responses are knowledgeable and helpful. The primary limitation of the Discord ticket system is the lack of an option to save conversations, unlike email or Live Chat support. Nevertheless, this system offers the fastest support for resolving any issues.

Social Media and Communication

Blue Guardian actively maintains a social media presence on platforms such as Instagram, X, and Telegram, as well as on Discord and YouTube.

X: Hosts a variety of content including news, promotional materials, announcements, and occasionally, prop trading-related memes.

Instagram: Features a blend of news, Trustpilot reviews, educational content, promotional material, and updates on new features.

Discord: Serves as a comprehensive platform for sharing announcements, marketing and trading updates, economic news, and security advice. It fosters a vibrant community atmosphere with channels dedicated to discussions, trading ideas, and success stories sharing.

YouTube: Channel contains promotional videos, announcements, interviews, and educational content.

Telegram: Mainly shares news, promotional content, and announcements, with the occasional inclusion of motivational quotes.

Client Reviews Summary

Rate: 4.6

Evaluations of the Blue Guardian platform:

| Review platform | Rating | Number of reviews |

|---|---|---|

| Trustpilot | 4,6 | 1200 |

With an overall rating of 4.6 out of 5, Blue Guardian demonstrates a predominantly positive reception among its user base, reflecting well on various aspects of its operations, including customer support. This high rating suggests that the positive experiences significantly outweigh the negative ones for the majority of users. However, it is important to consider this in the context of the detailed aspects of customer support:

Positive Contributions to High Rating:

- Positive Experiences and Seamless Payouts: Some users report positive interactions, including prompt payouts, excellent customer service, and a user-friendly dashboard.

- Responsiveness to Feedback: Blue Guardian seems to listen to community feedback, as evidenced by adjustments made after customer suggestions and criticisms.

- Educational Support: The company offers podcasts and educational content to aid traders in their journey, reflecting an investment in trader success.

- Community Engagement: Through activities like games and a Discord group, Blue Guardian fosters a sense of community and support among traders.

- Adaptability: The firm has shown adaptability by switching platforms in response to external changes in the trading environment, indicating flexibility and a proactive approach.

Negative Aspects Impacting the Rating:

- Negative Customer Experiences: Numerous accounts of negative interactions, including accounts of deceit, scam behavior, poor communication, and inadequate support.

- Platform and Broker Changes: The frequent changes in brokers and trading platforms have left some traders disadvantaged, unable to use their preferred tools and strategies.

- Lack of Transparency and Fairness: Allegations of a system designed to fail traders, with unclear or unjust account terminations and challenges in passing the evaluation process.

- Customer Service Issues: While some had good experiences, others found the support team incompetent, unresponsive, or dismissive, leading to unresolved issues and frustration.

- Financial and Operational Concerns: Complaints about high commissions with partner brokers, refund errors, and difficulties in resolving payment issues highlight operational and financial challenges.

Additional Features

Dashboard

Dashboard offers traders a comprehensive set of tools to monitor and evaluate their trading performance. Key components include:

- Detailed Stats: This section provides a textual display of important statistics like current equity, account balance, profitability, win/loss rates, number of trades, total lots, Risk-Reward Ratio (RRR), profit factor, and records of best/worst trades, successful long/short trades, and gross profit/loss.

- Trading History: Allows traders to review trade activities during the current cycle.

Guardian Protector

In the ever-evolving world of trading, risk management is paramount. Guardian Protector is a safeguard mechanism designed to protect your investments. This feature includes a stop loss percentage amount of 2%, ensuring that your trades are shielded against unexpected market fluctuations.

Limiting Your Daily Losses

The main goal of Guardian Protector is to protect your trading capital. With this tool, traders can set a daily loss limit that suits their risk tolerance. Once traders reach this limit, the system automatically halts trading for the day, preventing further losses.

Stop Overtrading

Overtrading is a common pitfall in the world of trading. Emotions can run high, and the temptation to recover losses by taking excessive risks can be overwhelming. Guardian Protector allows traders to block trading until the next trading day, offering a much-needed breather to cool off and reassess strategies.

Downloads

In this tab you can download the cTrader, Match-Trader and DXtrade platforms for Windows and macOS.

Summary

Blue Guardian was established in 2021. They offer one and two-phase challenges with values ranging from $10,000 to $200,000. The account size is suitable for both beginners and advanced traders. The company stands out for its 4% profit target in phase 2 of the challenges and an 85/15 profit split. Other advantages include the choice of three trading platforms: cTrader, Match-Trader, and DXtrade.

The customer service is of good quality, with live chat or Discord recommended for contact. Customer reviews are generally positive – 4.6 on Trustpilot. It’s worthwhile to follow the company’s updates on platform X, Instagram, and Telegram.

The disadvantages of the company include a daily loss limit of 4% and the lack of the MetaTrader platform for trading.

Blue Guardian presents an interesting alternative in the prop-trading market.

![10% Off For Traders Discount Code [2024]](https://fxprop.com/wp-content/uploads/2024/01/24.png)