Funding Traders Review: Is It Worth It?

Funding Traders is a company established in 2023 in the United Arab Emirates. It offers one and two-phase challenges with 6 account sizes, ranging from $5,000 to $200,000. It provides zero fees for challenge accounts and an 80/20 profit split (with an Add-On up to 100/0). Maximum sum of funds is $400,000 per customer.

It enables trading in the forex market, commodities, indices, and cryptocurrencies. Funding Traders uses CBT Market as liquidity provider. Customers can use the TradeLocker, cTrader, DXtrade and MetaTrader 5 platforms. The company accepts payments by credit card, bank transfer and cryptocurrencies.

Customer support is available all week through email and live chat, and the platform is active on social media as X, Instagram, Discord, and Telegram. Customer reviews are generally positive – 4.4 on Trustpilot.

Company Profile

Funding Traders

Company Info:

Company: MCF Group FZCO

Address: IFZA Business Park, DDP – 001, A1 – 3641379065, Dubai

Id No: DSCO-FZCO-24876

CEO of Funding Traders: Stan grew up in New York City where he started his Wall Street career at the age of 18 working for a stock brokerage firm. In 2008, he switched to investment management and trading full-time under the apprenticeship of an ex-UBS head of foreign exchange NY desk dealer. After doing that and a few stints in various funds and traditional prop firms, he went on to become a managing director of a large family office investment firm.

Key Information

2-step Challange

| Challenge name | 2-STEP |

|---|---|

| Challenge fee 100 000$ | $412 (after discount) |

| FX leverage | 1:100 |

| EA trading | Yes |

| News trading | Yes |

| Weekend holding | Yes |

Funding Traders In Detail

Challenge Type

2-Step

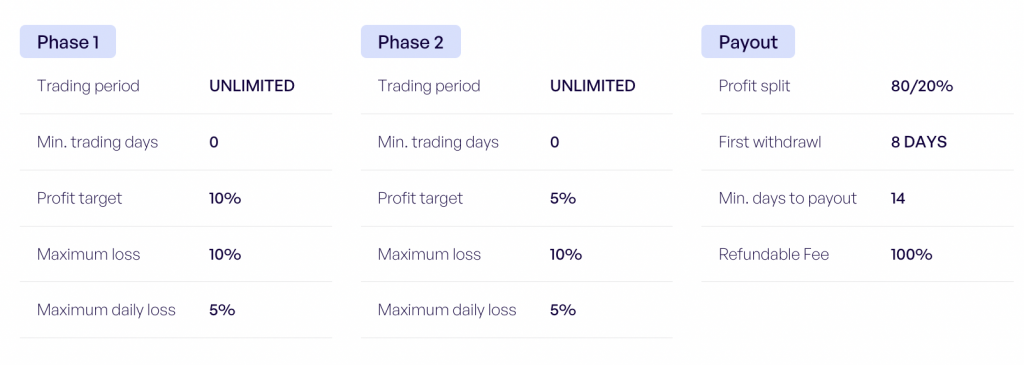

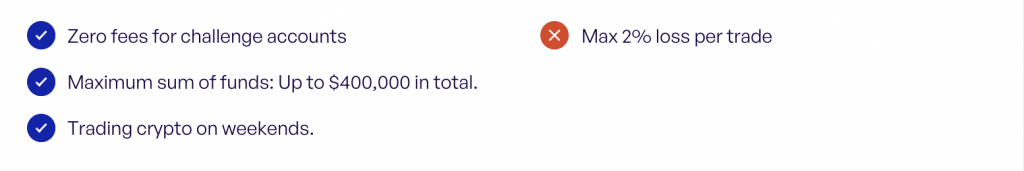

2-Step trading option involves two phases to qualify for a funded account. Investors can choose only Dollar with 6 account sizes. The maximum total funds available is $400,000.

Phase one requires an 10% profit with, daily drawdown up to 5%, overall drawdown up to 10%. There are also no limits regarding the maximum number of trading days. The minimum number of trading days is 1.

Phase two involves a 5% profit with similar drawdown conditions. The funded account phase has no specific profit targets, daily drawdown up to 5%, overall drawdown up to 10%. The minimum number of trading days is 1.

| Trading during weekends | Yes |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

1-Step

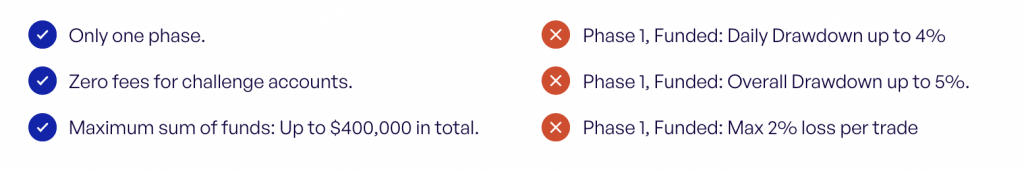

The 1 – Step Evaluation of prop trading challenge involves phase to qualify for a funded account. Investors can choose only Dollar with 6 account sizes. The maximum total funds available is $400,000.

Phase one requires an 10% profit with, daily drawdown up to 4%, overall drawdown up to 5%. There are also no limits regarding the maximum number of trading days. The minimum number of trading days is 1.

The funded account phase has no specific profit targets, daily drawdown up to 4%, overall drawdown up to 5%. The minimum number of trading days is 1.

| Trading during weekends | Yes |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

Scaling Plan

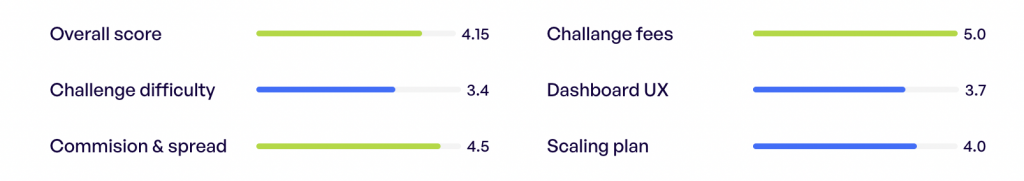

Rate: 4.0

At Funding Traders scaling plan is designed to support traders’ growth and provide them with larger allocations as they demonstrate their trading prowess.

Key Components of the Scaling Plan:

Maximum Scaling Capacity: $2,000,000.

Scaling Milestone: Achieve an 8% profit within 2 months to qualify for scaling.

Scale Increase: Accounts will be scaled by 25% of the initial capital upon reaching the milestone.

Example of Scaling Plan

| Initial Balance | $100 000 |

|---|---|

| 2 Months | $125 000 |

| 4 Months | $150 000 |

| 6 Months | $175 000 |

| 8 Months | $200 000 |

| 10 Months | $225 000 |

| Max Scaling | $2 000 000 |

Challenge Fees

Rate: 5

Comparison of Direct Challenge Costs

We compare the direct costs of participating in the challenge offered by Funding Traders – 2-Step Challenge with the average market costs. This analysis enables understanding of how Funding Traders fares against its competitors in terms of pricing. The costs for the challenge at Funding Traders for the 2-Step Challenge are below the market average.

*The price includes a discount available on the website.

| Challenge Size | Market Average Price | Challenge Price | Difference |

|---|---|---|---|

| 5 000$ | 56$ | 38$* | -63$ |

| 10 000$ | 108$ | 75$* | -33$ |

| 25 000$ | 209$ | 150$* | -59$ |

| 50 000$ | 310$ | 225$* | -85$ |

| 100 000$ | 515$ | 413$* | -102$ |

| 200 000$ | 969$ | 750$* | -219$ |

| 300 000$ | 1263$ | 1125$* | -138$ |

Comparison of Costs Relative to Drawdown

It is important to note that the size of drawdown has a significant impact on what we actually receive for the money spent. The 2 – Step Challenge has a drawdown at the level of 10%. Therefore, we additionally compare how much drawdown we receive in relation to the dollar spent.

| Challenge Size | Market Average Price [Drawdown$/$] | Challenge Price [Drawdown$/$] | Difference [Drawdown$/$] |

|---|---|---|---|

| 5 000$ | 8,0 | 13,3 | +5,3 |

| 10 000$ | 8,6 | 13,3 | +4,7 |

| 25 000$ | 11,4 | 16,7 | +5,3 |

| 50 000$ | 15,4 | 22,2 | +6,8 |

| 100 000$ | 18,5 | 24,2 | +5,7 |

| 200 000$ | 20,4 | 26,7 | +6,3 |

| 300 000$ | 24,2 | 26,7 | +2,5 |

Evaluation of the Cost-Effectiveness of the Funding Traders 2 – Step Challenge

Based on the above data, as well as algorithms we have developed, we assess the cost-effectiveness of purchasing the Funding Traders 2 – Step Account Challenge as very good compared to the market average. The expenditure efficiency in the context of drawdown indicates a better cost-effectiveness than the market average.

Assets

Forex

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | AUD/USD |

| CAD/CHF | CAD/JPY | CHF/JPY | EUR/AUD | EUR/CAD |

| EUR/CHF | EUR/GBP | EUR/JPY | EUR/NZD | EUR/USD |

| GBP/AUD | GBP/CAD | GBP/CHF | GBP/JPY | GBP/NZD |

| GBP/USD | NZD/CAD | NZD/CHF | NZD/JPY | NZD/USD |

| USD/CAD | USD/CHF | USD/JPY |

Commodities

| XAU/USD | XAG/USD | XTI/USD |

Cryptocurrencies

| BTC/USD | ETH/USD | ADA/USD | LTC/USD | XRP/USD |

| SOL/USD |

Indices

| USTEC | US500 | UK100 | DE40 | AUS200 |

| F40 | US30 | JP225 | RUS2000 | STOXX50 |

| CHC50 | ES35 | HKCHKD | N25 | SWI20 |

Trading Conditions

Server Provider

Funding Traders uses CBT Market as liquidity provider.

CBT Market

CBT is a leading broker solution for prop firms and brokerages offering a bridge to one of the best liquidity providers available – such as Broctagon.

The company offers solutions tailored to the financial markets, technology development, and proprietary trading industries, leveraging over 30 years of combined experience. Their focus is on optimizing businesses through innovative and easy-to-use solutions, particularly for brokers and prop trading firms. They provide systems for comprehensive business control, including risk management and technological advancement, to maximize profit opportunities. Specializing in marketing and technology, they assist in developing pioneering strategies and solutions, along with custom plug-ins and applications for brokers of all sizes.

Their services include:

- Dashboard White Label Solutions for starting branded brokerages or prop trading firms with minimal investment and expert support.

- A comprehensive Back Office CRM suite for broker management, including client interaction, compliance, sales, support, and reporting.

- Customizable prop firm setups with advanced dashboard technology.

- Highly customizable dashboards for unique branding and operational requirements.

- Custom development of various instruments and software for tailored business models.

- A Liquidity Bridge system for trading across multiple liquidity providers with robust risk management and data safety.

Platforms

Funding Traders offers trading on the TradeLocker, cTrader, DXtrade and MetaTrader 5 platforms.

Leverage

The leverage size offered by the Funding Traders is:

- Forex: Up to 1:100

- Indices/Gold: Up to 1:50

- Crypto: Up to 1:5

Deposits and Withdrawals

Deposits

Funding Traders accepts payments by credit card, bank transfer via Rise and cryptocurrencies. The company accepts cryptocurrency like:

| Bitcoin | Ethereum | Dogecoin | Litecoin | Bitcoin Cash |

| ApeCoin | Shiba Inu | USD Coin | DAI | Tether |

| Matic | Bridged USD Coin (Polygon Network) | Wrapped Ether (Polygon Network) |

Withdrawals

Funding Traders allows withdrawals via bank transfer and cryptocurrencies.

Rise (2-7 business days)

You may receive your payout straight to your bank by using Rise Pay. The minimum payout amount to receive your payout via Rise is $200.

1. Sign up for Rise.

2. Request for payout via Discord or Email.

3. Receive payout.

Cryptocurrencies – Coinbase/Binance (6-12 business hours)

Payout method is mainly USDT (ERC20). Crypto is the fastest withdrawal method (6-12 hours on average). The minimum payout commission requirement is $50.

1. Open a ticket on Discord or Email.

2. Request for payout with your Account Number and Crypto Wallet Address.

3. Receive payout.

Payout Schedule

Your payout is only available on the agreed payout schedule as per your signed TOS.

The default payout time is 14 days after you placed your first trade. If you purchased the 7-day payout time add-on, your payout time is 7 days after you placed your first trade.

Support

Funding Traders provides customer support through email and live chat. Below is a list of available channels:

- Physical Office Address – MCF Group FZCO, IFZA Business Park, DDP – 001, A1 – 3641379065, Dubai, Id No: DSCO-FZCO-24876.

- Email ID – help@fundingtraders.com

- Live Chat – Directly available from the site

- Help Center – https://help.fundingtraders.com/en

Email Support

Social Media and Communication

Funding Traders actively maintains a social media presence on platforms such as X, Instagram, Discord and Telegram.

| X | https://twitter.com/Funding_Traders |

| https://www.instagram.com/fundingtraderscom | |

| Discord | https://discord.com/invite/fundingtraders |

| Telegram | https://t.me/fundingtraders |

X content includes news, promotional material, announcements, inspirational quotes, and occasional reposts of users’ achievements on the Funding Traders Platform.

Instagram is utilized for sharing news, promos, and announcements through regular posts. Stories on this platform often include information about payouts, reviews, and updates.

Discord: On the Discord channel a variety of information is shared, including announcements, marketing updates, trading and economic updates, and security tips. There are also community-focused channels for discussions, trading ideas, and sharing success stories. The community is active and vibrant.

Telegram in channel predominantly features news, promotional content, and announcements. Additionally, it occasionally reposts users’ achievements from the Funding Traders Platform.

Engagement rate in social media:

| Platform | Followers | Engagement Rate |

|---|---|---|

| X | 26400 | 0,62 |

| 18400 | 1,04 |

Client Reviews Summary

Rate: 4.6

| Review platform | Raiting | Number of reviews |

|---|---|---|

| Trustpilot | 4.4 | 850 |

With an overall rating of 4.4 out of 5, Funding Traders demonstrates a predominantly positive reception among its user base, reflecting well on various aspects of its operations. This high rating suggests that the positive experiences significantly outweigh the negative ones for the majority of users. Here’s a summary of the main points:

Positive Aspects:

- Responsive Customer Support: Several reviews commend the prop firm for its responsive and helpful customer support, especially on platforms like Discord.

- Quick Payouts: Many users reported receiving their payouts promptly, with some noting that the payout process is faster than other prop firms, taking no more than a few hours in some cases.

- User-Friendly Platform: A few reviews mention that the firm’s platform is easy to use, with a simple layout and support for popular trading platforms.

- Opportunities for Traders: The firm offers opportunities for traders with limited capital to access larger trading accounts, with some reviews highlighting successful challenges and the chance to earn significant profits.

Negative Aspects:

- Consistency Rule and Hidden Conditions: A major point of contention among the negative reviews is the firm’s “consistency rule” or other hidden conditions that lead to traders being disqualified from challenges even after seemingly meeting the profit targets. This issue is often described as ambiguous and unfairly applied, leading some to label the firm as a scam.

- Poor Customer Service Experience: Despite positive mentions of specific support staff, there are numerous complaints about customer service being rude, unhelpful, or evasive when dealing with account issues or questions.

- Challenge and Account Issues: Several reviewers reported problems with the challenge process, including unclear rules, unexpected disqualifications, and issues with account setup. Some feel that the firm uses these challenges as a way to profit from participants without intending to payout.

- Design and Usability Concerns: A few users criticize the website’s design and usability, pointing out issues like poorly placed buttons that can lead to accidental selections or the lack of detailed information after purchasing a challenge.

Conclusion

In summary, while some traders have had positive experiences with timely support and payouts, a significant number of others report feeling misled by unclear rules, experiencing poor customer service, and encountering issues that prevent them from successfully completing challenges or receiving payouts. These mixed reviews suggest that potential customers should proceed with caution, thoroughly research the firm’s terms and conditions, and consider the varied experiences of past participants.

Additional Features

Account MetriX

The Account MetriX application is integrated into the website’s Client Area, offers traders a comprehensive set of tools to monitor and evaluate their trading performance. Key components include:

- Detailed Stats: This section provides a textual display of important statistics like current equity, account balance, profitability, win/loss rates, number of trades, total lots, Risk-Reward Ratio (RRR), profit factor, and records of best/worst trades, successful long/short trades, and gross profit/loss.

- Trading History: Allows traders to review trade activities during the current cycle.

Summary

Funding Traders is a relatively young company, founded in 2023. However, it appears to be an interesting alternative in the market.

They stand out with competitive prices and the diversity of their challenges. They offer one and two-phase challenges ranging from $5,000 to $200,000. The account size is suitable for both beginners and advanced traders. Advantages also include a maximum allocation of $400,000 per client and low fees and spreads. For challenge accounts, the fees are zero.

Customer service is of a good standard. Contact via live chat or Discord is recommended. Customer reviews are generally positive – 4.4 on Trustpilot. On platform X and Instagram, it’s worth following the news related to the company.

Disadvantages include a maximum loss of 2% per trade and a rather anonymous company team. The CEO of Funding Traders values his privacy and prefers to remain anonymous, introducing himself on the internet only by his first name.

Funding Traders is a company worth considering when choosing challenges.

![Funded Trading Plus Review [2024]](https://fxprop.com/wp-content/uploads/2024/07/38-2.png)

![Fidelcrest Honest Review [2024]](https://fxprop.com/wp-content/uploads/2024/06/38-1.png)

![10% Off For Traders Discount Code [2024]](https://fxprop.com/wp-content/uploads/2024/01/24.png)