Instant Funding Review

Instant Funding Introduction

Instant Funding is a company established in 2022 in the United Kingdom. Kindly note that Acello Ltd is the parent company of Instant Funding. It offers one and two-phase challenges with 5 account sizes ranging from $12,500 to $200,000. Their offering stands out as an Instant Funding Account offers a distinctive approach to trading, eliminating the need for traders to pass any evaluation phases. Instant Funding offers 80/20 profit split (up to 90/10) and maximum sum of funds is $600,000 per customer.

It enables trading in the forex market, commodities, indices, and cryptocurrencies. Instant Funding uses a tier-1 liquidity provider. Customers can use the DXtrade platform. The company accepts payments by credit card, bank transfer and cryptocurrencies.

Customer support is available all week through email and live chat, and the platform is active on social media as X, Instagram, Facebook, Discord, Youtube and Telegram. Customer reviews are generally positive – 4.6 on Trustpilot.

Company Profile

Instant Funding

Kindly note that Acello Ltd is the parent company of Instant Funding.

Location of Operations:

13 Hursley Road Chandler’s Ford, Eastleigh, Hampshire, England, SO53 2FW

Company Info:

Type: Private limited Company

Incorporated on: 24 June 2020

Nature of business (SIC):

- 47990 – Other retail sale not in stores, stalls or markets

- 85590 – Other education not elsewhere classified

Restricted countries: Afghanistan, Russia, Burundi, Central African Republic, Congo Republic, Cuba, Crimea, Democratic Republic of Congo, Eritrea, Guinea, Guinea-Bissau, Iran, Iraq, Liberia, Libya, Myanmar, North Korea, Papua New Guinea, North Korea, Somalia, South Sudan, Sudan, Syria, Vanuatu, Venezuela, Yemen and Zimbabwe.

CEO of Instant Funding: Lewis Mansbridge holds director positions in Acello Group Limited, Mansbridge Holdings LTD and Acello LTD. Additionally, Mansbridge has previously been a director in three dissolved companies: Platinum Featured LTD, Platinum FXS LTD, Woodbridge Enterprises LTD and held a director role in True FX Limited.

Key Information

2-phase Challenge

| Challenge name | 2-phase Challenge |

| Challenge fee 100 000$ | $432 (after discount) |

| FX leverage | 1:100 |

| EA trading | No |

| News trading | Yes |

| Weekend holding | Yes |

Instant Funding in Detail

Challenge Type

Two-Phase

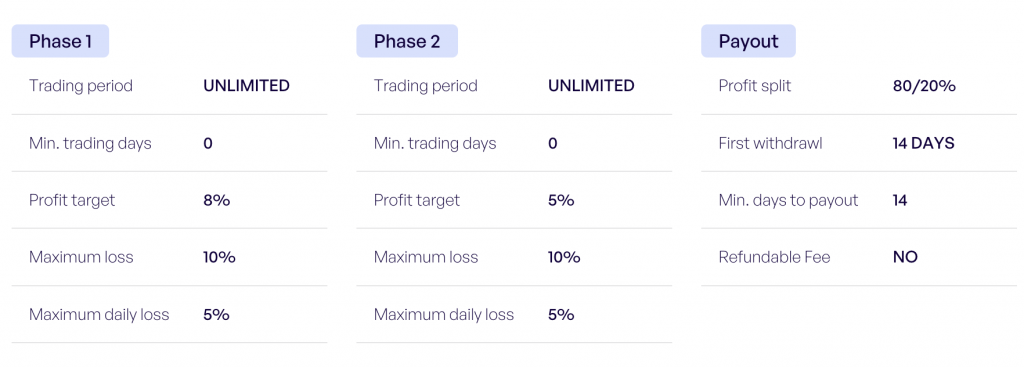

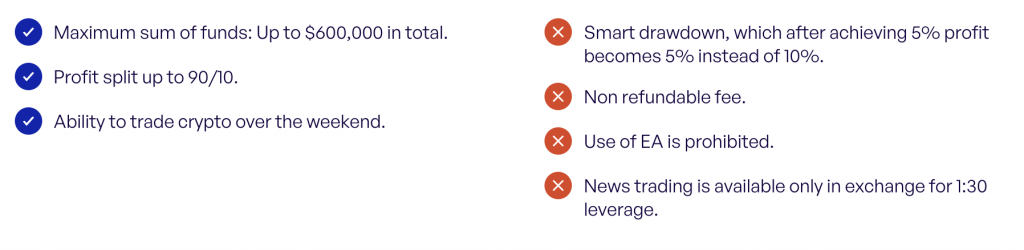

The Two-Phase Challenge involves two phases to qualify for a proprietary trading funded account. Investors can choose only Dollar, with five account sizes. The maximum total funds available is $600,000.

Phase one requires an 8% profit with, daily drawdown up to 5%, overall smart drawdown up to 10% (static drawdown available for an additional fee). There are also no limits regarding the maximum number of trading days and minimum trading days.

Phase two involves a 5% profit with similar drawdown conditions. The funded account phase has no specific profit targets, daily drawdown up to 5%, overall smart drawdown up to 10% (static drawdown available for an additional fee). There are also no limits regarding the maximum number of trading days and minimum trading days.

Instant Funding does not offer initial fee refund after advancement to the funded phase. The first withdrawal possible after 14 days. Subsequent withdrawals time interval is reduced to 7 days, and the profit split is 80/20 (scalable to 90/10). News trading is disabled on a funded phase initially, but can be enabled manually in exchange for 1:30 leverage.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | Yes |

| EA Trading | No |

| Cryptocurrencies | Yes |

One-Phase

The One-Phase Challenge involves one phase to qualify for a proprietary trading funded account. Investors can choose only Dollar, with five account sizes. The maximum total funds available is $600,000.

Phase one requires a 10% profit with, daily drawdown up to 3%, overall smart drawdown up to 10% (static drawdown available for an additional fee). There are also no limits regarding the maximum number of trading days and minimum trading days.

Instant Funding does not offer initial fee refund after advancement to the funded phase. The first withdrawal possible after 14 days. Subsequent withdrawals time interval is reduced to 7 days, and the profit split is 80/20 (scalable to 90/10). News trading is disabled on a funded phase initially, but can be enabled manually in exchange for 1:30 leverage.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | Yes |

| EA Trading | No |

| Cryptocurrencies | Yes |

Instant Funding

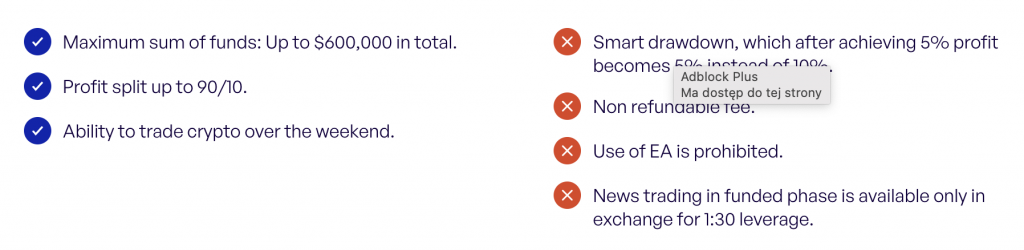

The Instant Funding Challenge offers a distinctive approach to trading, eliminating the need for traders to pass any evaluation phases. Upon purchasing this challenge, participants are immediately provided with a funded account. This challenge is characterized by the absence of profit targets, daily drawdown limits, and time constraints. Traders are limited to using the Dollar across seven different account sizes, with the total available funds capped at $600,000.

Instant Funding does not offer initial fee refund after advancement to the funded phase. The first withdrawal possible after 14 days. Subsequent withdrawals time interval is reduced to 7 days, and the profit split is 70/30 (scalable to 90/10). News trading is disabled initially, but can be enabled manually in exchange for 1:30 leverage.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | Yes |

| EA Trading | No |

| Cryptocurrencies | Yes |

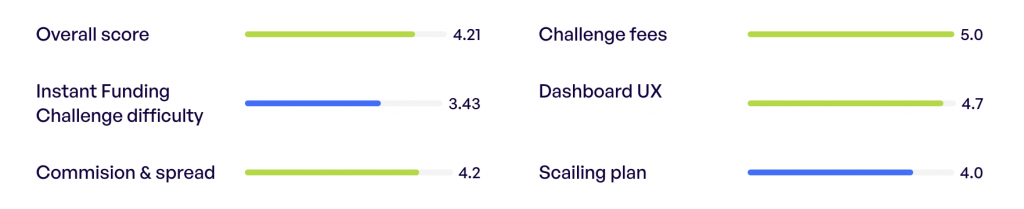

Scaling Plan

Rate: 4

Eligibility for account scaling requires a minimum achievement of a 10% gain on the account’s balance. Scaling procedures involve the use of 5% of the account’s initial balance, with the remaining profit retained by the account holder.

Consider an account with a starting balance of $100,000. Achieving a 10% gain, or $10,000, enables the account to be scaled to $200,000. During this process, 5% of the 10% gain, amounting to $5,000, is utilized for scaling, with the remaining profit being retained by the account holder.

Account scaling can be initiated through the designated button on the dashboard. This option becomes available when the account meets the eligibility criteria and all trades have been closed, as indicated on the home screen.

Account holders have the opportunity to scale their accounts up to $1,600,000 (Challenge) and $1,280,000 (Instant), thereby offering significant potential for growth.

It should be noted that during the scaling process, the basis for calculating loss limits is adjusted, but the methodology for calculating these limits remains unchanged.

Example of scaling plan

| Elapsed time | Initial Balance | Max daily loss | Max loss |

|---|---|---|---|

| Initial Balance | 50 000$ | 2 500$ | 5 000$ |

| 10% profit | 100 000$ | 5 000$ | 10 000$ |

| 10% profit | 200 000$ | 10 000$ | 20 000$ |

| 10% profit | 400 000$ | 20 000$ | 40 000$ |

| 10% profit | 800 000$ | 40 000$ | 80 000$ |

Challenge Fees

Rate: 5.0

Comparison of Direct Challenge Costs

We compare the direct costs of participating in the challenge offered by Instant Funding – Two-Phase Challenge with the average market costs. This analysis enables understanding of how Instant Funding fares against its competitors in terms of pricing. The costs for the challenge at Instant Funding for the challenge are well below the market average.

*The price includes a discount available on the website.

| Challenge Size | Market Average Price | Challenge Price | Difference |

|---|---|---|---|

| 25 000$ | 209$ | 134$* | -75$ |

| 50 000$ | 310$ | 242$* | -68$ |

| 100 000$ | 515$ | 431$* | -84$ |

| 200 000$ | 969$ | 832$* | -137$ |

Comparison of Costs Relative to Drawdown

It is important to note that the size of drawdown has a significant impact on what we actually receive for the money spent. The Evaluation Challenge has a drawdown at the level of 10%. Therefore, we additionally compare how much drawdown we receive in relation to the dollar spent.

| Challenge Size | Market Average Price [Drawdown $ / $] | Challenge Price [Drawdown $ / $] | Difference [Drawdown $ / $] |

|---|---|---|---|

| 25 000$ | 11,4 | 18,6 | +7,2 |

| 50 000$ | 15,4 | 20,7 | +5,3 |

| 100 000$ | 18,5 | 23,2 | +4,7 |

| 200 000$ | 20,4 | 24,0 | +3,6 |

Evaluation of the Cost-Effectiveness of the Instant Funding Account Challenge

Based on the above data, as well as algorithms we have developed, we assess the cost-effectiveness of purchasing the Instant Funding Account Challenge as very good compared to the market average. The expenditure efficiency in the context of drawdown indicates a better cost-effectiveness than the market average.

Assets

Forex

| AUDCAD | AUDCHF | AUDJPY | AUDNZD | AUDUSD |

| CADCHF | CADJPY | CHFJPY | EURAUD | EURCAD |

| EURCHF | EURCZK | EURGBP | EURHUF | EURJPY |

| EURNOK | EURNZD | EURPLN | EURTRY | EURUSD |

| GBPAUD | GBPCAD | GBPCHF | GBPJPY | GBPNZD |

| GBPUSD | GBPZAR | NZDCAD | NZDCHF | NZDUSD |

| USDCAD | USDCHF | USDHUF | USDJPY | USDMXN |

| USDNOK | USDSEK | USDSGD | USDZAR |

Commodities

| XAUUSD | XAUEUR | XAGUSD | WTI (USOUSD) | Brent (UKOUSD) |

Indices

| ASX200 | CAC40 | ESP35 | HK50 | JPN225 |

| STOXX50 | UK100 |

Cryptocurrencies

| BTCUSD | ETHUSD | LTCUSD | SOLUSD |

UX Rating

Rate: 4.7

The Instant Funding website stands out for its exceptional UX design, offering clear, accessible information, a streamlined registration process, and robust technological and trading infrastructure. It effectively guides users through understanding the company’s services, registering an account, and purchasing a trading challenge. The user-friendly design and consistent branding significantly enhance the user experience. Moreover, the site’s intuitive layout and informative content structure contribute to an effortless navigation experience.

Trading Conditions

Server Provider

Instant funding uses a tier-1 liquidity provider, but does not provide detailed information about the provider.

Platforms

Instant Funding offers trading on the DXtrade platform

Leverage

Leverage on One and Two-Phase Challenge Accounts:

- Forex 1:100

- Metals and Commodities 1:40

- Indices 1:20

- Crypto 1:2

Leverage on Instant Accounts:

- Forex 1:100

- Metals and Commodities 1:20

- Indices 1:10

- Crypto 1:2

Deposits and Withdrawals

Deposits

To purchase accounts, Instant Funding offers Stripe (Debit or credit cards), NOWPayments (Cryptocurrency – USDT), or Skrill as payment methods.

Withdrawals

First payout occurs 14 days after your first trade. After the first payout, this interval is reduced to every 7 days, following next placed trade.

Instant Funding exclusively uses RISE for all withdrawals. To request a payout, ensure all trades are closed and Smart Drawdown is locked in. The minimum payout threshold is $25 for all accounts. Request submission is available via dashboard, choosing Rise as the withdrawal method. Enter the amount you wish to withdraw and provide your email address. After this is requested, follow the instructions in the email from Rise to create an account and verify your identity. (This will be sent within 24 hours)

Withdrawal requests are generally processed within 24 business hours from receipt during the working week. Requests made at weekends or during a UK Bank Holiday will be processed on the next working day.

Please be aware if the bank details entered are wrong then you will be charged the swift fees for the transaction to be sent and returned. Please ensure the details are correct to avoid fees. (Only if rejected)

Support

Instant Funding provides customer support through email, live chat and discord. Below is a list of available channels:

- Physical Office Address –

- Email ID – support@instantfunding.io

- Live Chat – Directly available from the site

- Discord – https://discord.com/invite/zPynWcMq4V

Email Support

Customers can contact Instant Trading via email. This is a useful option if you require a formal response to your queries. Responses from support are substantive. The average response time for this communication method is several hours. Therefore, it is recommended to use live chat or discord support for much faster assistance.

Live Chat Support

Instant Funding has good live chat. Their expert team is always available in the online chat and aims to quickly and efficiently respond to all questions, thereby providing prompt and effective customer support. To start a chat, you need to provide an email address. The average response time, calculated based on chat interactions, is around 3 minutes. This method is considered the fastest for receiving support and resolving any possible issues.

Social Media and Communication

A recent analysis of Instant Funding’s presence across multiple social media platforms reveals a predominant strategy of primarily unidirectional communication. Their Discord channel emerges as the central focus of their social media endeavors, acting as a conduit not only for disseminating news and updates but also facilitating interactions between the company and its traders. Here is an overview of Instant Funding’s engagement on various platforms:

Facebook: Utilized for disseminating official announcements and promotional content.

X: Hosts a variety of content including news, promotional materials, announcements, and occasionally, prop trading-related memes.

Instagram: Features a blend of news, Trustpilot reviews, educational content, promotional material, and updates on new features.

YouTube: Channel contains promotional videos, announcements, interviews, and educational content.

Discord: Serves as a comprehensive platform for sharing announcements, marketing and trading updates, economic news, and security advice. It fosters a vibrant community atmosphere with channels dedicated to discussions, trading ideas, and success stories sharing.

Telegram: Mainly shares news, promotional content, and announcements, with the occasional inclusion of motivational quotes.

Engagement rate in social media:

| Platform | Followers | Engagement Rate |

|---|---|---|

| 82500 | 0,09 | |

| X | 15000 | 1,58 |

| 23000 | 2,59 | |

| Youtube | 950 | 94,3 |

Client Reviews Summary

Rate: 4.6

Evaluations of the Instant Funding platform:

| Review platform | Rating | Number of reviews |

|---|---|---|

| Trustpilot | 4,6 | 1250 |

With an overall rating of 4.6 out of 5, Instant Funding demonstrates a predominantly positive reception among its user base, reflecting well on various aspects of its operations, including customer support. This high rating suggests that the positive experiences significantly outweigh the negative ones for the majority of users. However, it is important to consider this in the context of the detailed aspects of customer support:

Positive Contributions to High Rating:

- Opportunity for Instant Funding: The firm offers traders the chance to start trading almost immediately after joining, which is appealing for those eager to dive into the markets without lengthy processes.

- Supportive Community and Customer Service: Some users have highlighted the firm’s active and supportive community, especially on platforms like Discord, where traders can interact and share insights. Also, instances of very helpful customer support were mentioned, indicating the firm’s attempt to address trader concerns.

- Innovative Features: Features such as smart drawdown and scaling mechanisms are appreciated by some traders, providing a unique approach to managing risk and capital growth.

- Quick Withdrawals: There are accounts of fast withdrawal processes, which is a crucial factor for traders looking to access their profits swiftly.

- Competitive Profit Sharing and Payouts: The firm offers competitive profit-sharing models, with some traders able to achieve high payouts, which can be very attractive.

Negative Aspects Impacting the Rating:

- Technical and Platform Issues: Traders reported significant technical problems, such as a lack of chart data, rejected orders, and issues with platform migration, leading to frustration and operational challenges.

- Questionable Business Practices: Allegations of scams, using fake reviews, and unfair account terminations raise concerns about the firm’s integrity and reliability.

- Unfavorable Trading Conditions: Some traders criticized the firm’s trading conditions, such as high commissions, swap fees, and confusing drawdown calculations, which could disadvantage traders.

- Account Management and Funding Issues: Problems with instant funding, such as delays and lack of compensation during transition periods, were highlighted, along with frustrations over account management policies.

- Lack of Transparency and Communication: Instances of perceived lack of transparency, especially regarding account breaches and the rationale behind certain trading rules, have led to distrust among some traders.

Summary

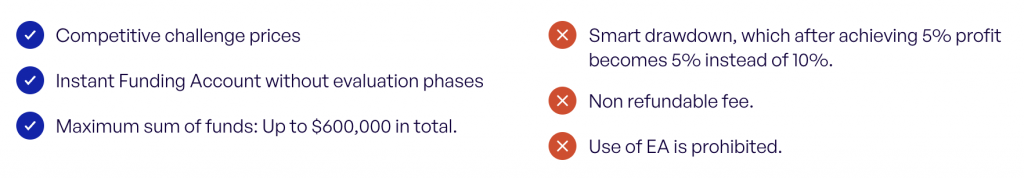

Instant Funding is a relatively young company, founded in 2022. However, it appears to be an interesting alternative in the market.

They stand out with competitive prices and the diversity of their challenges. They offer one and two-phase challenges ranging from $12,500 to $200,000. The account size is suitable for both beginners and advanced traders. Advantages also include a maximum allocation of $600,000 per client and low fees and spreads. A distinctive account is the Instant Funding Account, which does not require an evaluation phase.

Customer service is of a good standard. Contact via live chat or Discord is recommended. Customer reviews are generally positive – 4.6 on Trustpilot. On platform X, Instagram and Telegram, it’s worth following the news related to the company.

The disadvantages include the lack of a refundable fee, the prohibition of using EAs (Expert Advisors) in trading, and smart drawdown (static drawdown available for an additional fee). Inconveniences also encompass the possibility of payment with only one cryptocurrency (USDT). The company also does not provide information about its liquidity provider, while ensuring that they use a tier-1 liquidity provider.

Instant Funding presents an interesting alternative in the prop-trading market.

![10% Off For Traders Discount Code [2024]](https://fxprop.com/wp-content/uploads/2024/01/24.png)