For Traders Review Is Here!

For Traders Introduction

The For Traders company was founded in 2023 in the Czech Republic. It also has its headquarters in Dubai.

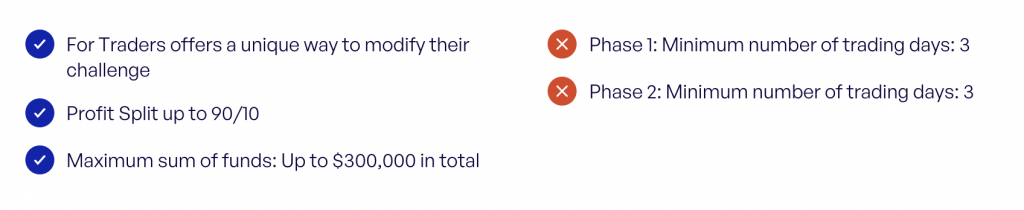

For Traders offers one and two-phase challenges that are a unique way to modify their challenge by allowing Traders to customize almost all of the key challenge conditions. The Profit Split is 90/10 (80/20 option is available for price reduction). The platform utilizes its own broker, who enable trading on forex, indices, commodities and cryptocurrencies.

Company allows deposits using major credit cards and cryptocurrency. Withdrawals can be made via cryptocurrency or bank transfer, with a minimum payout threshold of $100. Trustpilot reviews highlight the platform’s quick and efficient withdrawal process.

For Traders offers customer support via email and live chat, along with a physical office in Dubai. Support is available 24/5, excluding weekends. Users can also reach out through various social media platforms like YouTube, Discord, Facebook, Instagram, and X.

Company Profile

For Traders

Location of Operations:

BLN Tech Club DMCC

Goldcrest Executive Building, Office No. 1210, JLT, Cluster C, Dubai, United Arab Emirates

Company Info:

Date of Incorporation: 2023

Type: Financial Services

Restricted countries: Pakistan, Iran, Syria, Myanmar, North Korea, the Russian Federation, the Republic of Belarus, Cuba, Lebanon, Libya, Sudan, Crimea, Donetsk, and Luhansk regions of Ukraine.

CEO of For Traders: Jakub Roz is a serial tech entrepreneur and stock investor, widely recognized for his expertise in both fields. He is the CEO and Co-Founder of For Traders, and founder of Strike.market, a leading stock research website that empowers investors with alternative data.

LinkedIn: https://www.linkedin.com/in/jakubroz

Key Information

Two-Step Challenge

| Challenge name | Two-Step Challenge |

|---|---|

| $100k Challenge Fee | $642 (after discount) |

| FX leverage | 1:40 |

| EA trading | Yes |

| News trading | Yes |

| Weekend holding | Yes |

For Traders in Detail

Challenge type

Two-Step Challenge

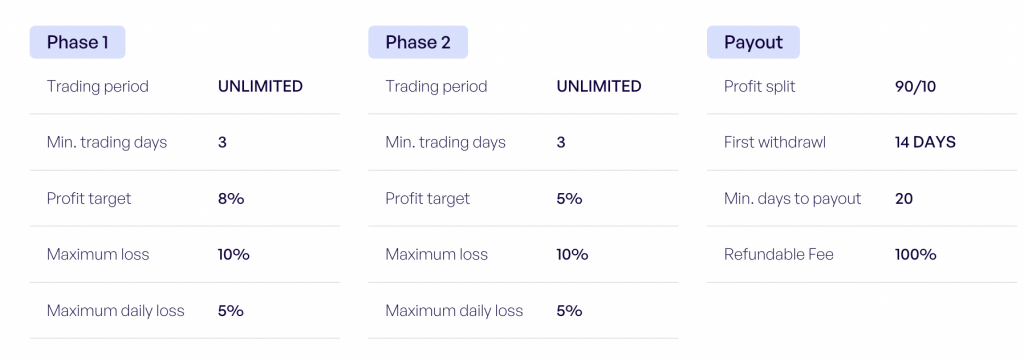

Two-Step requires completion of 2 phases to receive a funded account. Account purchase is only available in USD. There are 5 account sizes to choose from $5,000 to $100,000. The maximum total funds available is $300,000.

For Traders Two-Step Challenge has a leverage level of up to 1:125. The total amount of funds available to the investor cannot exceed 300,000$. This means, for example, an investor can have three 100,000$ accounts at most. For Traders offers a unique way to modify their challenge by allowing Traders to customize almost all of the key challenge conditions. For additional payment or price reduction, compared to default offer, users can modify the profit target of the first and the second phase, max drawdown, daily drawdown, payout schedule, profit split percentage and even refund percentage. All of the phase goals above would be shown the way they are shown on the For Traders website as the default offer:

First Phase Targets/Conditions:

- Achieve a 8% profit without specified time frames (10% as an option).

- Daily Drawdown up to 4% of the current account balance (5% as an option).

- Overall Drawdown up to 9% of the initial account balance (10% as an option).

- Minimum number of trading days: 3.

- Challenge Leverage: up to 1:125.

Second Phase Targets/Conditions:

- Achieve a 5% profit without specified time frames (7% as an option).

- Daily Drawdown up to 4% of the current account balance (5% as an option).

- Overall Drawdown up to 9% of the initial account balance (10% as an option).

- Minimum number of trading days: 3.

- Challenge Leverage: up to 1:125.

Funded Account Targets/Conditions:

- No specific profitability targets.

- Daily Drawdown up to 4% of the current account balance (5% as an option).

- Overall Drawdown up to 9% of the initial account balance (10% as an option).

- No minimum number of trading days required.

- Challenge Leverage: up to 1:125.

After progressing to this stage, the investor receives a 100% Refundable Fee (125% option is available). The first payout can be made 14 days after the first trade. Subsequent payouts can be made every two weeks (every week payout option is available). The Profit Split is 90/10 (80/20 option is available for price reduction), meaning the investor receives 90% of the profit generated by them.

| Trading during weekends | No |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

Two-Step Lite Challenge

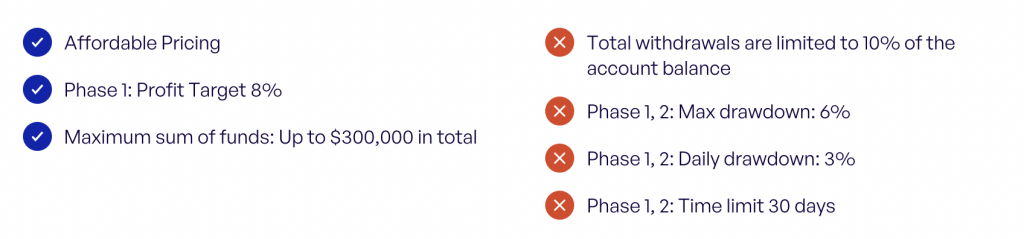

Two-Step Lite requires completion of 2 phases to receive a funded account. Account purchase is only available in USD. There are 4 account sizes to choose from $10,000 to $100,000. The maximum total funds available is $300,000.

Two-Step Lite Specifications:

- Available Account Sizes: Traders can choose from $10k, $25k, $50k, and $100k options.

- Fixed Targets and Limits: The challenge features an 8% profit target (phase 1) and 5% (phase 2), with a maximum drawdown limit of 6% and a daily drawdown limit of 3%.

- Profit Split and Refund: Profit split is fixed at 80% and refund is fixed at 100%.

- Time Limit: Each phase of the evaluation has a 30-day time limit.

- Withdrawal Cap: Total withdrawals are limited to 10% of the account balance. Once this limit is reached, the account will be considered depleted.

- Affordable Pricing: The Two-Step Lite challenge is priced significantly lower than the original Two-Step Challenge. For instance, the price for the $100k Two-Step Challenge Lite is $359, compared to $476 for the original $100k Two-Phase Challenge

| Trading during weekends | No |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

One-Step Challenge

One-Step requires completion of 1 phases to receive a funded account. Account purchase is only available in USD. There are 5 account sizes to choose from $5,000 to $100,000. The maximum total funds available is $300,000.

For Traders One-Step Challenge has a leverage level of up to 1:125. The total amount of funds available to the investor cannot exceed 300,000$. This means, for example, an investor can have three 100,000$ accounts at most. For Traders offers a unique way to modify their challenge by allowing Traders to customize almost all of the key challenge conditions. For additional payment or price reduction, compared to default offer, users can modify the profit target of the first and the second phase, max drawdown, daily drawdown, payout schedule, profit split percentage and even refund percentage. All of the phase goals above would be shown the way they are shown on the For Traders website as the default offer:

First Phase Targets/Conditions:

- Achieve a 9% profit without specified time frames (11% as an option).

- Daily Drawdown up to 3% of the current account balance.

- Overall Drawdown up to 6% of the initial account balance.

- Minimum number of trading days: 3.

- Challenge Leverage: up to 1:125.

Funded Account Targets/Conditions:

- No specific profitability targets.

- Daily Drawdown up to 3% of the current account balance.

- Overall Drawdown up to 6% of the initial account balance.

- No minimum number of trading days required.

- Challenge Leverage: up to 1:125.

After progressing to this stage, the investor receives a 100% Refundable Fee (125% option is available). The first payout can be made 14 days after the first trade. Subsequent payouts can be made every two weeks (every week payout option is available). The Profit Split is 90/10 (80/20 option is available for price reduction), meaning the investor receives 90% of the profit generated by them.

| Trading during weekends | No |

|---|---|

| Weekend Holding | Yes |

| News Trading | Yes |

| EA Trading | Yes |

| Cryptocurrencies | Yes |

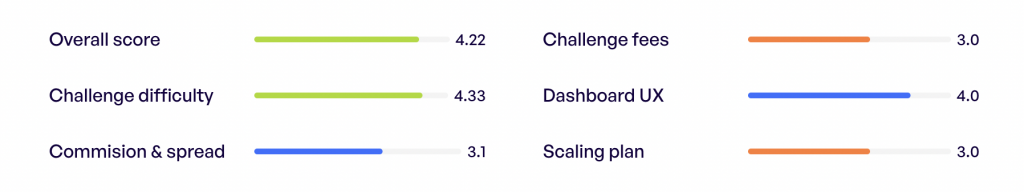

Scaling Plan

Rate: 3.0

The For Traders Scaling Plan offers a structured approach to strategic planning, enabling traders to systematically increase their trading account size following specific criteria and milestones.

Key Features of the ForTraders Scaling Plan

- Incremental Account Growth: The plan allows traders to increase their account size by 25% after successfully completing Phase 2. This increment is in line with market standards and is a significant feature of the plan.

- No Minimum Profit Requirements: Unlike some scaling plans, the For Traders approach does not necessitate minimum profit requirements for scaling up. This aspect could potentially attract a wider range of traders who are confident in their trading strategies but may not always meet high profit thresholds.

- Maximum Scale Target: The plan sets a realistic yet ambitious maximum account size target of $1.5 million. This target is designed to promote solid and consistent trading strategies, steering away from high-risk, high-reward tactics that are often unsustainable for the majority of traders.

- Transparent Scaling Process: The scaling process under this plan is straightforward and transparent. Every four months, the profitability of a trader’s account is reviewed. If the account shows profitability, the plan provisions for a 25% increase in the account balance in the subsequent fifth month.

- Initial Account Setup and Growth Potential: Starting with an initial account setup of $100k, under this plan, a trader’s account could potentially grow to $125k. This growth also proportionally adjusts the daily and overall drawdown limits, allowing traders to maximize their successful trades.

- Restart Clause: In the event of a loss in an account under the scaling plan, traders are required to restart with the original account setup. This clause is integral to maintaining a fair and sustainable trading environment for all participants in the plan.

The For Traders Scaling Plan is structured to foster responsible account growth among traders. By focusing on realistic growth targets and offering a transparent process, the plan is geared towards encouraging stable and consistent trading strategies. The absence of minimum profit requirements for scaling up makes it accessible to a broader spectrum of traders. However, the restart clause in case of a loss ensures that the plan maintains a balance between opportunity and responsibility.

Here’s an example of how an account could be scaled up over five iterations under the ForTraders Scaling Plan with initial balance of $100000:

| Account Increase | New Account Size | New Daily Drawdown | New Overall Drawdown |

|---|---|---|---|

| 25% of $100,000 | $125,000 | 6,250 | 12,500 |

| 25% of $125,000 | $156,250 | 7,812 | 15,625 |

| 25% of $156,250 | $195,312.50 | 9,765 | 19,531 |

| 25% of $195,312.50 | $244,140.63 | 12,207 | 24,414 |

| 25% of $244,140.63 | $305,175.79 | 15,258 | 30,517 |

Challenge Fees

Rate: 3.0

Comparison of Direct Challenge Costs

We compare the direct costs of participating in the challenge offered by For Traders – Two-Step with the average market costs. This analysis enables understanding of how For Traders fares against its competitors in terms of pricing. The costs for the challenge at For Traders for the Two-Step Challenge are above the market average.

*The price includes a discount available on the website.

| Challenge Size | Market Average Price | Challenge Price | Difference |

|---|---|---|---|

| 5 000$ | 56$ | 72$* | +16$ |

| 10 000$ | 108$ | 121$* | +13$ |

| 25 000$ | 209$ | 254$* | +45$ |

| 50 000$ | 310$ | 364$* | +54$ |

| 100 000$ | 515$ | 643$* | +128$ |

| 200 000$ | 969$ | 1214$* | +245$ |

Comparison of Costs Relative to Drawdown

It is important to note that the size of drawdown has a significant impact on what we actually receive for the money spent. The Evaluation Challenge has a drawdown at the level of 10%. Therefore, we additionally compare how much drawdown we receive in relation to the dollar spent.

| Challenge Size | Market Average Price [Drawdown$/$] | Challenge Price [Drawdown$/$] | Difference [Drawdown$/$] |

|---|---|---|---|

| 5 000$ | 8 | 6,9 | -1,1 |

| 10 000$ | 8,6 | 8,3 | -0,3 |

| 25 000$ | 11,4 | 9,9 | -1,2 |

| 50 000$ | 15,4 | 13,8 | -1,1 |

| 100 000$ | 18,5 | 15,6 | -1,8 |

| 200 000$ | 20,4 | 16,5 | -3,2 |

Evaluation of the Cost-Effectiveness of the For Traders Account Challenge

Based on the above data, as well as algorithms we have developed, we assess the cost-effectiveness of purchasing the For Traders Challenge as poor compared to the market average. The expenditure efficiency in the context of drawdown indicates a worse cost-effectiveness than the market average.

Assets

Forex

| EURUSD | USDJPY | GBPUSD | USDCHF | AUDUSD |

| USDCAD | NZDUSD | AUDCAD | AUDCHF | AUDJPY |

| AUDNZD | AUDSGD | AUDZAR | CADCHF | CADJPY |

| CHFHUF | CHFJPY | CHFZAR | EURAUD | EURCAD |

| EURCHF | EURCZK | EURGBP | EURHUF | EURJPY |

| EURMXN | EURNOK | EURNZD | EURPLN | EURRUB |

| EURSEK | EURSGD | EURZAR | GBPAUD | GBPCAD |

| GBPCHF | GBPJPY | GBPNZD | GBPSGD | GBPZAR |

| NOKSEK | NZDCAD | NZDCHF | NZDJPY | NZDSEK |

| NZDSGD | SGDJPY | USDCZK | USDHKD | USDHUF |

| USDILS | USDMXN | USDNOK | USDPLN | USDRUB |

| USDSEK | USDSGD | USDZAR | ZARJPY |

Commodities

| XAUUSD | XAGUSD | XPDUSD | XPTUSD | CL |

| BRENT | NGAS |

Indices

| DAX | DOW | FTSE | NSDQ | HK50 |

| NIKKEI | SP | STOXX50 | CAC | ASX |

Cryptocurrencies

| BTCUSD | ETHUSD | BCHUSD | LTCUSD |

Trading Conditions

Server Provider

For Traders uses its unique broker and manages its own servers. Proprietary servers and brokers, as employed by prop trading firms like For Traders, offer both benefits and drawbacks. Advantages may include reduced position fees and better server reliability, as these servers are dedicated to serving the firm’s trading clients. However, owning proprietary servers may also elevate risks such as potential price manipulation or delays, an issue brought to light by incidents like that with MyForexFunds.

Platforms

ForTraders offers trading on the MetaTrader 5 and DXtrade platforms.

Laverage

For both Phases of the Challenge you have a leverage of 1/125 for Forex, 1/20 for Indices, 1/20 for Stocks, 1/40 for Commodities and 1/3 for Crypto.

Since you can keep the trade open at your discretion over the weekend and you can trade important news as well, the leverage for the Funded part is reduced to Forex 1/40, Indices 1/10, Stocks 1/20, Commodities 1/10, Crypto 1/2.

Deposits and Withdrawals

Deposits

For Traders accepts all major credit, bank, and cryptocurrency cards. Once you make a payment, you will immediately gain access to your account. Currently besides card payment ForTraders accepts only cryptocurrencies for a small commission fee (~2$), which is refundable with the first profit split.

Payments can be made with cryptocurrencies such as:

| Bitcoin | Bitcoin Lightning | Ethereum | Litecoin |

| Tron | Solana | Tether | USD Coin |

Withdrawals

For Traders users, although trading with simulated capital, are eligible to receive real money rewards if they successfully generate “profit” in their For Traders account. This system rewards users who can demonstrate their trading skills by profitably managing simulated capital.

The policy for requesting payouts is as follows: Traders may request their first payout after a 14-day period of successful trading. Subsequent payouts can be requested either bi-weekly or weekly, based on the account plan selected by the user. Once a payout request is made, the process of transferring funds is typically completed within 24 hours.

Withdrawal of funds is facilitated through the “Payouts” section located in the user dashboard, specifically under the “Request New Payout” area. The minimum threshold for payouts is set at $100. When users accumulate the minimum required amount, they can initiate a payout request. ForTraders offers two payout options: Cryptocurrency or Bank Transfer.

The reviews on Trustpilot about For Traders withdrawal process are overwhelmingly positive. Positive feedback often praises the quick withdrawal approval and processing time.

Support

For Traders provides customer support through email and live chat. Below is a list of available channels:

- Physical Office Address – Goldcrest Executive Building, Office No. 1210, JLT, Cluster C, Dubai, United Arab Emirates

- Email ID – support@fortraders.com

- Live Chat – Directly available from the site.

For Traders Support Timings – Support is here for you 24/5, excluding weekends.

Email Support

You can contact For Traders via email. The average waiting time for a response is 40 minutes. We recommend turning to the online chat, as it is more convenient and faster.

Live Chat Support

For Traders strongly recommend using their online chat as the primary method of communication. To start a chat, you need to provide an email address, to which responses from the chat will be sent. Usually, the expected waiting time for the first response is between 10 to 30 minutes, depending on the day. The average response time, calculated based on chat interactions, is around 15 minutes.

For Traders has a poor live chat. Indeed, chat staff respond substantively to the questions asked. In case of doubts, they expand on the topics. They use links with information that can be found on their website. They provide answers to all the asked questions, but the waiting time definitely does not encourage conversation. Also misleading may be the information displayed at the start in the live chat window, stating that the service will return the next day. Support operates from Monday to Friday, however, the response time is much slower than industry standards indicate. After all, this method is considered the fastest for receiving support and resolving any possible issues.

Social Media and Communication

For Traders actively maintains a social media presence on platforms such as Facebook, X, Instagram and Youtube, as well as on TikTok, Discord and LinkedIn.

Facebook – For Traders actively manages a group on Facebook. Mostly, the information here is similar to that on the Instagram page and X. The frequency of posts is 20-30 per month.

X – In this social network, various types of contests, giveaways, client payouts, news about changes and innovations, as well as advertisements for new videos on YouTube are published.

Instagram – On the Instagram page, a sufficient amount of information is published about promotions, contests, promo codes, giveaways, as well as announcements about new interviews. Frequency of posts 30-40 per month.

YouTube – On the YouTube channel, you can find interviews with traders and interesting videos on how to increase your trading efficiency. The frequency of publication is up to 5 videos per month.

TikTok – On the TikTok platform, the company publishes brief information about contests, as well as partial materials for understanding trading in the markets. Activity is very low. Videos are published very rarely. Only a few videos in half a year.

Discord – On this channel, there is a lot of varied and useful information such as news, giveaways, contests. Traders also share information about their payments from the company. There is support, a general chat, a chat with trading ideas from traders, a gaming chat, funny memes, and educational materials. The activity on the Discord channel is high.

LinkedIn – On this platform, you can find information about the company, the employees, and the job vacancies that the company needs.

Engagement rate in social media:

| Platform | Followers | Engagement Rate |

|---|---|---|

| 1 800 | 20,02 | |

| X | 11 100 | 1,25 |

| 74 200 | 0,30 | |

| Youtube | 5 150 | 3,85 |

Client Reviews Summary

Rate: 4.6

Evaluations of the For Traders platform:

| Review platform | Rating | Number of reviews |

|---|---|---|

| Trustpilot | 4,6 | 350 |

With an overall rating of 4.6 out of 5, For Traders demonstrates a predominantly positive reception among its user base, reflecting well on various aspects of its operations, including customer support. This high rating suggests that the positive experiences significantly outweigh the negative ones for the majority of users. However, it is important to consider this in the context of the detailed aspects of customer support:

Positive Contributions to High Rating:

- Helpful and Responsive Support: Several users have complimented the platform for its excellent customer support, quick responses, and professional approach.

- Good Challenge Conditions and Transparency: Many users appreciate the fair challenge conditions, transparency in operations, and the clarity of rules, with no hidden surprises.

- Profitable Opportunities: Positive reviews highlight the profitable opportunities offered by the platform, including a high profit split, weekly payouts, and successful trading experiences.

- Community and Educational Support: The firm is praised for its community engagement, educational live streams, and events like giveaways and scalping events, fostering a learning environment for traders.

- Flexibility and Customization: Users have noted the flexibility to adjust trading conditions to suit individual needs and the option to customize challenges, enhancing user experience.

Negative Aspects Impacting the Rating:

- Issues with Refunds and Payments: Some users have encountered problems with refunds and payments, including delays and unfulfilled refund requests, leading to distrust.

- Account and Challenge Management Concerns: Complaints about challenges being unfairly failed, issues with KYC verification, and problems with account management have been raised.

- Technical Issues and Spread Concerns: There are mentions of technical issues like network problems on trading platforms and concerns over spreads, especially during news events, affecting trading efficiency.

- Banning and Blocking of Users: Certain users have reported being banned or blocked from the platform, especially when raising queries or issues, indicating a lack of openness to feedback.

- Perceived Lack of Professionalism: Some users perceive a lack of professionalism in the platform’s handling of user issues and concerns, as well as in their communication and overall management.

Conclusion:

The high rating of the platform is attributed to its helpful and responsive support, fair challenge conditions, transparency, profitable opportunities, community and educational support, and flexibility in customization, all enhancing the user experience. However, this positive perception is countered by issues such as problems with refunds and payments, challenges in account and challenge management, technical difficulties, and concerns about spreads, which lead to user distrust. Additionally, the platform faces criticism for banning and blocking users who raise issues, and a perceived lack of professionalism in handling user concerns and communication, suggesting areas for improvement.

Additional Features

Dashboard

The Dashboard is a tool designed to offer users a central hub for accessing information related to their trading activities.

Within the Dashboard, users can access the following key components:

Trading setup button, by pressing which user can find tutorial on how to set up trading tools as well as credentials to the user’s trading platform.

Challenge details button, by pressing which user will gain access to basic challenge details, such as starting balance, plan, status, challenge start date, challenge end date, platform and broker

Challenge progress section: This section provides a showcase of the user’s trading journey, offering details on current challenge phase as well as real time data on trading days, maximum total drawdown, daily loss and profit.

Your trading account section: A showcase of the user’s trading progress is featured, including a graphical representation of the user’s performance throughout their challenge. Data such as balance, equity, maximum total drawdown, profit, and daily loss are depicted on this graph.

Trading Journal

The “Trading Journal” section is designed to provide traders with a comprehensive review of their trade activities during the current trading cycle. This section is divided into two parts: overall trading statistics and the trading journal itself.

In the overall statistics segment, users can access the following information:

- Total P&L: This represents the total sum of money either gained or lost since the beginning of the respective stage.

- Profit Factor: This metric evaluates the effectiveness of a trading strategy by comparing gross profits to gross losses. For instance, a Profit Factor of 2 indicates that for every dollar lost, two dollars were earned.

- Average Winning Trade: This is the average amount of money gained from profitable trades since the beginning of the respective stage.

- Average Losing Trade: This is the average amount of money lost from unprofitable trades since the beginning of the respective stage.

- Winning Percentage by Trades: This shows the ratio of winning to losing trades since the beginning of the respective stage.

- Daily Net Cumulative P&L: A performance metric that tracks the total net profit or loss accumulated on a daily basis since the beginning of the respective stage.

Meanwhile, the trading history table is structured to streamline the process of recording and analyzing trading activities. Its design focuses on providing a clear and organized overview of trades.

Summary

For Traders is already a recognizable brand in the world of prop trading. It stands out with an interesting and original offer of challenges. For Traders offers one and two-phase challenges. Company offers a unique way to modify their challenge by allowing Traders to customize almost all of the key challenge conditions.

It’s worth noting that in the Scaling Plan, you can increase the account size to $1.5 million, but there is no minimum profit requirement to scale it. The Profit Split is 90/10 (80/20 option is available for price reduction). The company uses three liquidity providers, which protects users from issues with liquidity and market access.

On the downside, the company has relatively slow customer service and challenge prices above the market average.

For Traders is a company well-rated by users. It is recommended for clients who like flexible challenge conditions.

![10% Off For Traders Discount Code [2024]](https://fxprop.com/wp-content/uploads/2024/01/24.png)