Fidelcrest Honest Review [2024]

Fidelcrest is a company established in 2018 in Cyprus. It offers two-phase challenges with 5 account sizes, ranging from $15,000 to $200,000. The platform offers a growth opportunity where traders can increase their funds every quarter, up to $2,000,000.

It enables trading in the forex market, commodities, indices, cryptocurrencies and stocks. Fidelcrest uses Foreign Exchange Clearing House as liquidity provider. Customers can use the MetaTrader 4 and MetaTrader 5 platforms. The company accepts payments by credit/debit cards.

Customer support is available Monday to Friday via email and live chat. Fidelcrest is active on social media as Facebook, X, Instagram, Discord, YouTube, Telegram and TikTok. Customer reviews are generally positive – 4.2 on Trustpilot.

Company Profile

Fidelcrest

Location of Operations:

Arch. Makariou III & 1-7 Evagorou, MITSI 3, 1st floor, office 102 C, 1065 Nicosia, Cyprus

Company Info:

Date of Incorporation: September 2018

Type: Financial Services

Company size: 11-50 employees

Restricted countries: Canada, Iran, Pakistan, Somalia, USA.

Fidelcrest does not have a CEO. It is managed by a board of investors. The company does not provide information about them.

Key Information

2-phase Challenge

| Challenge name | Pro Trader Normal |

|---|---|

| Challenge fee 100 000$ | $1396 |

| FX leverage | 1:100 |

| EA trading | No |

| News trading | No |

| Weekend holding | Yes |

Fidelcrest In Detail

Challenge type

Pro Trader Challenge

The Pro Trader Challenge consists of two stages for qualifying for a funded proprietary trading account. This challenge is available in two formats: Normal and Aggressive, with distinctions in pricing, profit targets for both evaluation phases, as well as daily and total drawdown limits. Account purchase is available only in Euros, with a choice between two account sizes and a maximum funding capacity of $2,000,000.

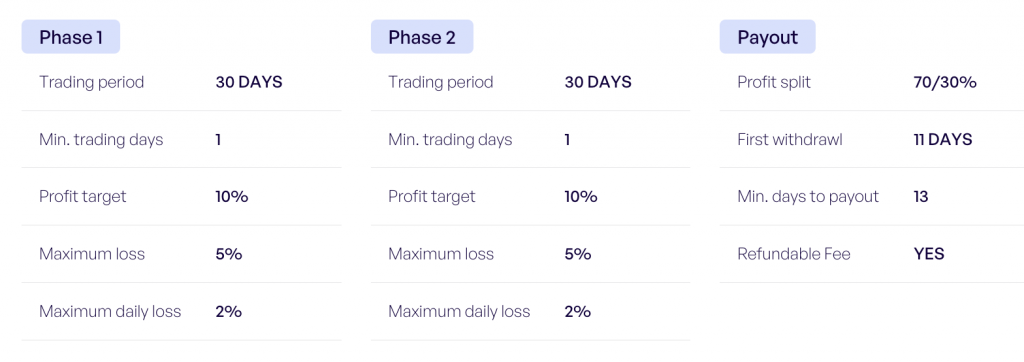

In the first phase, the Normal variation requires a 10% profit achievement and the Aggressive variation requires a 14% profit, with daily drawdown limits set at 2% for Normal and 4% for Aggressive, and total drawdown limits at 5% for Normal and 8% for Aggressive. Traders must complete both evaluation phases within a 60-day period, necessitating at least one trading day to advance to the subsequent phase.

The second phase maintains identical profit and drawdown requirements as the first phase, with the same 60-day completion timeframe and the necessity for at least one trading day for progression.

Successful progression through the challenge entitles traders to a fully refundable fee. The initial withdrawal is allowed after 10 days, provided that the trader has secured at least a 10% profit. Additional withdrawals can be requested every 10 days, with profits divided at a 70/30 split between the trader and the firm.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | No |

| EA Trading | No |

| Cryptocurrencies | Yes |

Challenge Type

Micro Trader challenge

The Micro Trader consists of two stages for qualifying for a funded proprietary trading account. This challenge is available in two formats: Normal and Aggressive, with distinctions in pricing, profit targets for both evaluation phases, as well as daily and total drawdown limits. Account purchase is available only in Euros, with a choice between three account sizes and a maximum funding capacity of $2,000,000.

In the first phase, the Normal variation requires a 15% profit achievement and the Aggressive variation requires a 10% profit, with daily drawdown limits set at 2% for Normal and 3% for Aggressive, and total drawdown limits at 3% for Normal and 7% for Aggressive. Traders must complete both evaluation phases within a 60-day period, necessitating at least one trading day to advance to the subsequent phase.

The second phase maintains identical profit and drawdown requirements as the first phase, with the same 60-day completion timeframe and the necessity for at least one trading day for progression.

Successful progression through the challenge entitles traders to a fully refundable fee. The initial withdrawal is allowed after 10 days, provided that the trader has secured at least a 5% profit. Additional withdrawals can be requested every 10 days, with profits divided at a 70/30 split between the trader and the firm.

| Trading overnight | Yes |

|---|---|

| Trading during weekends | Yes |

| News Trading | No |

| EA Trading | No |

| Cryptocurrencies | Yes |

Scaling Plan

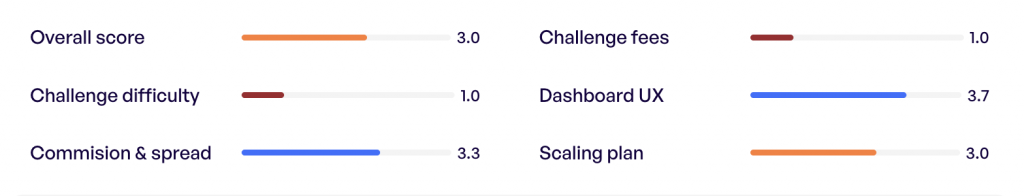

Rate: 3.0

To qualify for a 25% capital increase, a trader must achieve a minimum total gain of 15% over three consecutive months, averaging a 5% gain each month, with each month concluding positively. Additionally, the account balance must exceed the initial starting balance of the trader’s Professional Account at the time of scaling. Should the balance fall below the Professional Account’s initial balance, the 25% increase will be deferred until the account balance returns to a positive figure by the end of the trading period.

The capital will be augmented by 25% of the initial balance every three months, provided the aforementioned conditions are continually satisfied, until the account balance has doubled.

The progression of the account balance for a Professional Account is illustrated in the table below:

| Elapsed Time | Capital Increase |

|---|---|

| 0 months | $100 000 |

| 3 months | $125 000 |

| 6 months | $150 000 |

| 9 months | $175 000 |

| 12 months | $200 000 |

Challenge Fees

Rate: 1.0

Comparison of Direct Challenge Costs

We compare the direct costs of participating in the challenge offered by Fidelcrest – Micro Trader / Pro Trader Challenge with the average market costs. This analysis enables understanding of how Fidelcrest fares against its competitors in terms of pricing. The costs for the challenge at Fidelcrest for the challenge are slightly above the market average for Micro Trader. However, in case of the Pro trader challenge costs are drastically above the market average.

| Challenge Size | Market Average Price | Challenge Price | Difference |

|---|---|---|---|

| $10 000 | $108 | $107 | -$1 |

| $25 000 | $209 | $225 | +$16 |

| $50 000 | $310 | $314 | +$4 |

| $100 000 | $515 | $1409 | +$894 |

| $200 000 | $969 | $2385 | +$1416 |

Comparison of Costs Relative to Drawdown

It is important to note that the size of drawdown has a significant impact on what we actually receive for the money spent. The Evaluation Challenge has a drawdown at the level of 10%. Therefore, we additionally compare how much drawdown we receive in relation to the dollar spent.

| Challenge Size | Market Average Price [Drawdown $/$] | Challenge Price [Drawdown $/$] | Difference [Drawdown $/$] |

|---|---|---|---|

| $10 000 | 8,6 | 4,7 | -3,9 |

| $25 000 | 11,4 | 5,6 | -5,8 |

| $50 000 | 15,4 | 8,0 | -7,4 |

| $100 000 | 18,5 | 3,6 | -14,9 |

| $200 000 | 20,4 | 4,2 | -16,2 |

Evaluation of the Cost-Effectiveness of the Fidelcrest Account Challenge

Based on the above data, as well as algorithms we have developed, we assess the cost-effectiveness of purchasing the Fidelcrest Account Challenge as very poor compared to the market average. The expenditure efficiency in the context of drawdown indicates a well below cost-effectiveness than the market average.

Assets

Forex

| AUDCAD | AUDCHF | AUDHUF | AUDJPY | AUDNZD |

| AUDSEK | AUDSGD | AUDUSD | CADCHF | CADJPY |

| CHFHUF | CHFJPY | CHFNOK | EURAUD | EURCAD |

| EURCHF | EURCZK | EURDDK | EURGBP | EURHUF |

| EURILS | EURJPY | EURMXN | EURNOK | EURNZD |

| EURPLN | EURSEK | EURUSD | EURZAR | GBPAUD |

| GBPCAD | GBPCHF | GBPDKK | GBPHUF | GBPJPY |

| GBPNOK | GBPNZD | GBPPLN | GBPTRY | GBPUSD |

| NOKSEK | NZDCAD | NZDCHF | NZDHUF | NZDJPY |

| NZDUSD | SGDJPY | USDBRL | USDCAD | USDCHF |

| USDCLP | USDCNH | USDCZK | USDDKK | USDHKD |

| USDHUF | USDILS | USDJPY | USDMXN | USDNOK |

| USDPLN | USDSEK | USDSGD | USDZAR |

Metals

| XAUUSD | XAGUSD |

Commodities

| UKOIL | USOIL |

Indices

| AUS200 | CAC40 | DAC40 | HK50 | JP255 |

| SPA35 | STOXX50 | UK100 | US100 | US30 |

| US500 |

Cryptocurrencies

| BTCUSD | ETHUSD | BATUSD | BCHUSD | BNBUSD |

| DSHUSD | EOSUSD | ETCUSD | IOTUSD | LTCUSD |

| NEOUSD | OMGUSD | TRXUSD | XLMUSD | XMRUSD |

| XRPUSD | ZECUSD |

Stocks

| AA | AAPL | ADBE | AMZN | AXP |

| BA | BABA | BAC | CAT | CMCSA |

| COST | CSCO | CVX | DELTA | DIS |

| EBAY | GE | GOOG | GS | HD |

| HPQ | IBM | INTC | JNJ | JPM |

| KO | MCD | META | MMM | MO |

| MRK | MSFT | NFLX | NKE | NVDA |

| ORCL | PEP | PFE | PG | QCOM |

| RACE | SBUX | SYMC | TSLA | TWTR |

| VZ | WMT | WU | XOM | YNDX |

UX Rating

Rate: 3.7

Fidelcrest website provides a solid foundation for presenting its services and facilitating user interactions. Information on the company’s prop trading program, trading challenges, and performance-based capital allocation model is easily accessible. While the trading platform is functional, a more intuitive interface and advanced features would better serve experienced traders. The website could also benefit from more detailed explanations of the program’s structure and terms. A clearer and more prominently highlighted CTA could potentially increase conversions. Additionally, incorporating user feedback mechanisms and interactive elements could further enrich the user experience, making it more engaging and informative.

Trading Conditions

Server Provider

Fidelcrest uses Foreign Exchange Clearing House as liquidity provider.

Foreign Exchange Clearing House

FXCH, a private company primarily engaged in the Financial Software industry, was established in 2016. It is headquartered in Dublin, Ireland. The company operates a platform for managing foreign exchange transactions, designed to streamline the trade clearing process by removing extraneous steps. Utilizing blockchain technology, the platform facilitates the clearing of foreign exchange in forex and global markets, helping clients reduce unnecessary clearing-related expenses. FXCH is not regulated by any regulators. Investors’ funds in this broker are unsafe and cannot be protected by any law.

Platforms

Fidelcrest offers trading on the MetaTrader 4 and MetaTrader 5platforms.

Leverage

Leverage on accounts:

- 1:100 – Forex

- 1:33 – Metals

- 1:10 – Indices, Stocks

- 1:2 – Crypto

The trader can receive double leverage. However, this would also result in a 10% increase in the Challenge Price.

Deposits and Withdrawals

Deposits

Upon receipt of payment, the accounts team at Fidelcrest will establish an account with the chosen broker and set the initial balance. Clients will then receive an email containing login details and a link to install MT4. New accounts are typically created within a few hours on business days (Monday to Friday). Should Fidelcrest be selected as the broker, account creation is immediate due to the fully automated process.

Supported Payment Methods:

- Credit/Deposit Card (available globally)

- Skrill

- Neteller

- Wire Transfer

Withdrawals

Payouts can be requested every 10 days, on condition that the trader has achieved a minimum profit of 5% for the Micro Trader challenge and 10% for the Pro Trader challenge.

Fidelcrest offers the following payout methods:

- Wire Transfer

- PayPal

- Neteller

- Skrill

Withdrawal requests are typically processed within 1-3 business hours upon receipt during the working week. Withdrawals to bank accounts outside the SEPA area incur a 50€ fee.

Support

Fidelcrest provides support through email, chat and ticket system 24 hrs mon-fri. Despite information that support is closed during the weekend our team was able to contact the support team via live chat during the weekends on multiple occasions. Below is a list of available channels:

- Physical Office Address – Arch. Makariou III & 1-7 Evagorou, MITSI 3, 1st floor, office 102 C, 1065 Nicosia, Cyprus

- Email ID – support@fidelcrest.com

- Create a Ticket – https://direct.lc.chat/10945667

- Live Chat – Directly available from the site

Email support

Email support is available at Fidelcrest. After sending the message, we receive feedback about the ticket number received. Then we wait for answers to questions. While the support provided via email is relevant, responses can sometimes be too general or incomplete. The average response time for emails is two days. For quicker and more detailed assistance, it is recommended to use the Live Chat feature and enhance the conversation with additional questions.

Live Chat support

The live chat on Fidelcrest is the preferred method of communication for obtaining quick responses from a team of experts. Upon activating the chat, you must provide your name and email address. Then, you select whether you are a new user or an existing customer of Fidelcrest. After making your selection, the bot connects you with customer service. The response time ranges from 1 to 3 minutes, with an average response time based on interactions being 2 minutes. Live Chat responses are informative and knowledgeable, making it quickest support option for addressing concerns. The chat history is not saved.

Social Media and Communication

Fidelcrest actively maintains a social media presence on platforms such as Facebook, Instagram, X, and Telegram, Discord as well as on TikTok and YouTube.

Facebook – The Facebook group serves as a space for official announcements and a community hub where traders can share their accomplishments and trading results.

X: Hosts a variety of content including news, promotional materials, announcements, and occasionally, prop trading-related memes.

Instagram: Features a blend of news, Trustpilot reviews, educational content, promotional material, and updates on new features.

Discord: Serves as a comprehensive platform for sharing announcements, marketing and trading updates, economic news, and security advice. It fosters a vibrant community atmosphere with channels dedicated to discussions, trading ideas, and success stories sharing.

YouTube: Channel contains promotional videos, announcements, interviews, and educational content.

Telegram: Mainly shares news, promotional content, and announcements, with the occasional inclusion of motivational quotes.

TikTok: TikTok page includes promotional materials, announcements and educational content.

Client Reviews Summary

Rate: 4.2

Evaluations of the Fidelcrest platform:

| Review platform | Rating | Number of reviews |

|---|---|---|

| Trustpilot | 4,2 | 1900 |

With an overall rating of 4.2 out of 5, Fidelcrest demonstrates a predominantly positive reception among its user base, reflecting well on various aspects of its operations, including customer support. This high rating suggests that the positive experiences significantly outweigh the negative ones for the majority of users. However, it is important to consider this in the context of the detailed aspects of customer support:

Positive Contributions to High Rating:

- Responsive Customer Support: Some users appreciated the prompt and helpful customer support, particularly from specific staff members who answered queries quickly and resolved issues efficiently.

- Good First Impressions: The customer support team sometimes made a good first impression by being available even on weekends and providing prompt responses.

Negative Aspects Impacting the Rating:

- Accusations of Scamming: Many users accused the firm of scamming traders by failing accounts for unspecified or inconsistent reasons and withholding funds.

- Delayed Payments: Users frequently mentioned delays in payments and reviews, with some waiting months beyond the advertised time frames.

- Unfair Rule Changes: Traders reported sudden and unexpected changes to trading rules, such as restrictions on news trading and lot size limitations, which were not initially disclosed.

- Poor Transparency: There was a significant lack of transparency in communication, with many users feeling misled about the terms and conditions of their trading challenges.

Additional Features

Dashboard

Dashboard offers traders a comprehensive set of tools to monitor and evaluate their trading performance. Key components include:

- Detailed Stats: This section provides a textual display of important statistics like current equity, account balance, profitability, win/loss rates, number of trades, total lots, Risk-Reward Ratio (RRR), profit factor, and records of best/worst trades, successful long/short trades, and gross profit/loss.

- Trading History: Allows traders to review trade activities during the current cycle.

Economic Calendar

The website features a calendar with events. It provides the ability to filter by days, the significance level of events, and currencies. This allows for quick filtering, enabling users to select the events they are interested in. It is a main tool for proprietary trading.

Summary

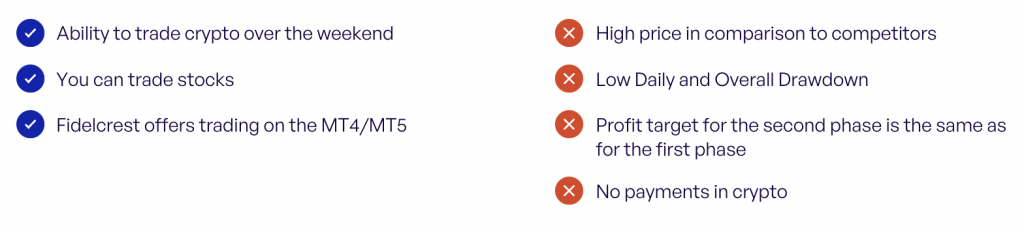

Fidelcrest was established in 2018 in Cyprus. It offers Micro and Pro Trader challenges, covering challenges of various sizes from $15,000 to $200,000. The account sizes are suitable for both beginners and advanced traders. While Micro Trader accounts are priced similarly to the market average, Pro Trader accounts are priced much above the market average. The company stands out negatively for its challenge rules, offering small drawdowns and a high profit target in phase two of the challenge.

The advantages of Fidelcrest’s challenges include the ability to trade crypto on weekends, the availability of stocks for trading, and trading on the most popular platforms such as MetaTrader 4 and MetaTrader 5.

Customer service is rated as good, with live chat recommended for contact. Customer reviews are generally positive, with a 4.2 rating on Trustpilot. It is advisable to follow the company’s updates on Discord, X, and Instagram.

Apart from high prices and very restrictive challenge rules, the disadvantages include the lack of cryptocurrency payment options, as well as a ban on using Expert Advisors (EA) and news trading.

Fidelcrest could be an alternative for users looking to diversify their funds in the world of prop trading, but it is a company with one of the poorer offerings on the market.

![Glow Node Review: Is Glow Node a Good Prop Firm? [2024]](https://fxprop.com/wp-content/uploads/2024/05/38.png)

![10% Off For Traders Discount Code [2024]](https://fxprop.com/wp-content/uploads/2024/01/24.png)